On July 13, 2025, former President Muhammadu Buhari died in a clinic in London, United Kingdom, at the age of 82.

A retired major general and one of Nigeria’s most prominent political figures, Buhari served first as military head of state from 1983 to 1985, before returning as an elected president in 2015.

His two-term civilian presidency, which ended in 2023, was defined by a sweeping anti-corruption agenda, an economic reform programme, and sustained efforts to address insecurity across the country.

Nigeria’s economy experienced a mix of significant highs and painful lows under the late president. From two recessions to aggressive currency reforms and debt accumulation, Buhari’s administration left behind a complex economic legacy.

Advertisement

As his death continues to gather tributes following the announcement by Garba Shehu, the former president’s spokesperson, TheCable presents some of the economic developments that shaped Buhari’s eight-year tenure.

NIGERIA’S TWIN RECESSIONS

Nigeria slipped into recession twice during Buhari’s administration.

Advertisement

The first occurred in 2016, largely due to a sharp decline in global oil prices, and the poor management of the currency crisis.

The second recession came in 2020, following the COVID-19 pandemic, which disrupted global trade, weakened oil demand, and triggered economic contraction.

It was the first time Nigeria experienced two recessions within one administration.

SUPPORT FOR NIGERIANS IN INTERNATIONAL ORGANISATIONS

Advertisement

During Buhari’s presidency, Nigeria secured high-level leadership roles in major international organisations.

He endorsed Ngozi Okonjo-Iweala for director-general of the World Trade Organisation (WTO), supported Akinwumi Adesina and nominated him for a second term as president of the African Development Bank (AfDB).

Benedict Oramah was reappointed for a second term as president of Afreximbank under Buhari’s government in 2020.

COVID-19 ECONOMIC RESPONSE AND STIMULUS PLAN

Advertisement

To cushion the economic blow of the COVID-19 pandemic, the Buhari administration launched the N2.3 trillion economic sustainability plan (ESP) in 2020.

The initiative focused on job creation, micro, small, and medium enterprises (MSME) support, and agriculture.

Advertisement

Buhari also inaugurated the national poverty reduction with growth strategy (NPRGS) steering committee, with a stated goal to lift 100 million Nigerians out of poverty over 10 years — primarily through agriculture and economic diversification.

FULL IMPLEMENTATION OF THE TSA

Advertisement

Although the treasury single account (TSA) was introduced under former President Goodluck Jonathan, it was fully implemented by Buhari’s government in September 2015.

The TSA consolidated all government revenues into a single account with the CBN, aimed at improving transparency and curbing financial leakages across ministries, departments, and agencies (MDAs).

Advertisement

BORDER CLOSURES

In August 2019, Buhari’s government ordered the partial closure of land borders.

The policy aimed to curb smuggling and encourage local production of rice — pushing food prices higher.

The government reopened four major land borders in December 2020 amid growing criticism and economic strain.

RECORD-LOW OIL PRODUCTION

Despite being Africa’s largest oil producer, Nigeria witnessed a consistent decline in crude oil output under Buhari.

In 2022, at a time when global oil prices surged past $130 per barrel following Russia’s invasion of Ukraine, countries like Saudi Arabia raked in windfall revenues. Nigeria, however, struggled to meet its OPEC production quota.

With an output of 1.39 million barrels of oil in January, 2022, the country’s production declined for four consecutive months before it increased to 1.15 million bpd in June.

In July, production averaged just 1.08 million bpd, and by August, it dropped below the 1 million bpd mark — Nigeria’s lowest level in decades. Output only rose modestly in October and November to 1.01 million bpd and 1.18 million bpd, respectively.

Throughout 2022, Nigeria was unable to surpass 1.4 million bpd oil output.

OFF-SPEC PETROL SAGA

In February 2022, panic spread across the country after substandard petrol was distributed in Nigeria.

The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) later confirmed that petrol with methanol content above acceptable limits had entered the market.

Mele Kyari, who was the NNPC Group chief executive officer at the time, said the adulterated product had been imported by several companies, including MRS, Oando, Emadeb Consortium, and Duke Oil — a subsidiary of NNPC. The companies denied the allegations.

Following the incident, oil marketers initiated a phased recall of the off-spec product to prevent widespread distribution, while regulators formed a technical committee to address the issue.

The withdrawal of the affected product created a supply gap, triggering scarcity nationwide. It was worst product contamination ever experienced.

OIL THEFT

In 2021, Nigeria’s oil production ranged between 1.4 million and 1.7 million bpd. However, a combination of challenges — including widespread oil theft and frequent pipeline vandalism — led to a sharp decline in output in 2022.

In June 2022, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) reported that the country lost $1 billion in the first quarter of the year to oil theft.

Later in November, the senate committee investigating oil theft and its consequent damage to the country’s economy revealed that Nigeria lost N1.3 trillion ($2 billion) to oil theft between January and August 2022.

Apart from the losses recorded, significant volumes of crude oil were shut-in consistently due to theft.

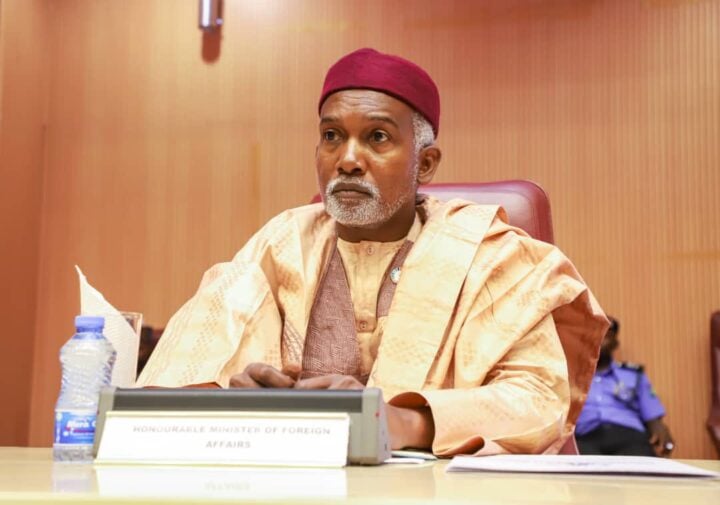

NNPC TRANSITION TO COMMERCIAL COMPANY

In a major structural reform, the Nigerian National Petroleum Corporation (NNPC) transitioned into a limited liability company in July 2022.

At the unveiling ceremony, Buhari said the NNPC Limited would operate “free from institutional regulations, such as the treasury single account, public procurement, and fiscal responsibility act”.

Buhari added that the company would deliver value to over 200 million shareholders (Nigerians) following the transition.

SOARING PUBLIC DEBT

According to the Budget Office, total federal revenue between 2016 and 2022 stood at N26.67 trillion, while expenditure reached N60.64 trillion — resulting in a deficit of N33.97 trillion.

The massive shortfall was covered through domestic borrowing, with the federal government’s local debt rising from N8.84 trillion in December 2015 to N44.91 trillion by June 2023. Over the same period, external debt increased from $7.35 billion to $37.2 billion.

This excludes ways and means borrowing from the CBN, which amounted to over N25 trillion.

Overall, Buhari raised Nigeria’s debt stock from N42 trillion to N77 trillion — significantly increasing debt servicing costs from N1.06 trillion in 2015 to N5.24 trillion by 2022.

EXCHANGE RATE VOLATILITY AND NAIRA DEPRECIATION

The naira lost significant value during Buhari’s tenure. In 2015, the official exchange rate was about N197 to the US dollar.

At the end of Buhari’s administration, the exchange rate in the official market was N464.51, while that of the black market averaged N762.

NAIRA REDESIGN

In terms of monetary policies in 2022, the central bank announced plans to redesign, produce, release and circulate a new series of three banknotes out of the existing eight banknotes.

The redesigned N200, N500, and N1000 notes were slated for circulation on December 15, 2022.

The bank said the current series of the aforementioned naira notes will remain legal tender until January 31, 2023.

The move was targeted at controlling currency in circulation, curbing counterfeiting, and reducing the amount of cash available to the public to “pay ransoms to kidnappers”.

The newly redesigned naira notes were officially unveiled by Buhari on November 23.

The new notes were criticised by many Nigerians who described the change as a “repainting –not redesigning”.