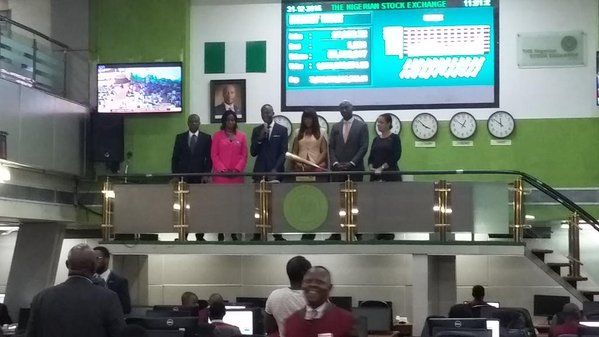

Omotola Jalade-Ekeinde, Nigeria’s acting queen, rang the closing bell to put an end to the Nigeria Stock Exchange (NSE) 2015.

Omotola, as she is fondly called, joined Goodluck Jonathan, Sunday Oliseh and a host of others who rang the NSE stock closing bell for 2015, as she closed market for Thursday and 2015.

The NSE opened up on January 2, with a market capitalisation of N13.23 trillion, and ended the year at N9.85 trillion, shedding N3.38 trillion in 12 months.

Advertisement

The 26 percent loss has been attributed to the initial political uncertainties that preceded the 2015 elections, the change in power and consequent delay in policy direction of the new government.

The top gainer for the last day of 2015 was Nestle Nigeria, who saw its stock rise by N35 to N860 per share on the Nigerian bourse.

The last trading day of 2015 also saw construction company, Julius Berger, lose N1 on every share for the day.

Advertisement

Other top gainers include, Forte Oil, Nigerian Brewies , Dangote Cement, and Mobil, while Julius Berger was followed on the losing train, by Cadbury, Cutix, Skye Bank and Fidson Pharmaceuticals.

Oscar Onyema, the chief executive officer of the NSE, initially admitted in January 2015, that it had become impossible for the NSE to attain its target market cap of N198 trillion ($1 trillion) set for 2015.

“It is not possible to realise the $1 trillion market capitalisation given the present economic situation”, he said.

“It is still on course but it can take from 18 months and above before the process can be concluded. So for this year we are not considering that but a lot of work is being done.”

Advertisement

“We expect that as the year progresses, underpinned by a successful election with no or low levels of violence, a tighter grip on the security situation in north-eastern Nigeria, and a more certain macroeconomic outlook for oil prices, interest rates and the naira, the market’s attractiveness could improve rather significantly.”