Oba Otudeko, former First Bank chairman, has sold off his shares in First HoldCo, two years after acquiring them.

On July 10, 2023, TheCable reported that Otudeko-led Honeywell acquired 4.7 billion shares of FBN Holdings (now known as First HoldCo).

However, on Wednesday, Otudeko took part in one of the largest trades recorded by First HoldCo, as a total of 10.43 billion shares of the company were traded.

The deals representing about 25 percent of the company’s total outstanding shares were traded in 17 negotiated deals at a fixed price of N31 per share.

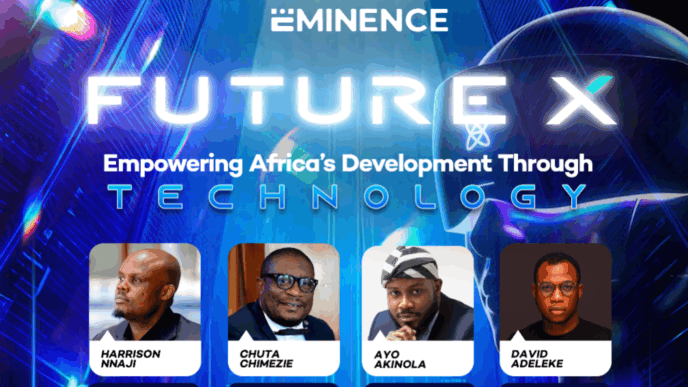

Advertisement

The transaction, valued at N323.45 billion, is believed to be a strategic ownership shift.

While there has been no official statements, sources familiar with the matter told TheCable that the shares sold belonged to entities linked to Otudeko.

TheCable understands that the buyer in all 17 deals was First Securities Ltd, while the sellers included CardinalStone Securities, Meristem Stockbrokers, Renaissance Capital, Regency Asset Management, Stanbic IBTC Stockbrokers, United Capital Securities, and First Securities Ltd (acting as both buyer and seller in select trades).

Advertisement

The transaction now clears the path for Femi Otedola, currently the largest individual shareholder, to consolidate his control within the group.

OTUDEKO’S TIMES AT FIRST HOLDCO

Between the late 2000s and early 2020s, First Bank’s balance sheet came under pressure from a string of ‘non-performing insider-related loans’ to companies allegedly linked to Otudeko.

The loans included Aiteo Group with reported exposures exceeding N150 billion; Seawolf Drilling, a deepwater oil services firm that collapsed under debt; and Investors International London Limited (ILL), which failed in its bid to acquire NITEL in 2001.

Advertisement

In 2021, the Central Bank of Nigeria (CBN) intervened, dissolving the board of First Bank and reinstating its managing director.

The apex bank cited corporate governance failures and insider abuse as major concerns.

In December 2021, Femi Otedola became the single largest shareholder after acquiring 7.57 percent of the issued shares capital of FBNH.

But in July 2023, Otedola lost his position to Otudeko, who acquired 4.7 billion shares of FBN Holdings.

Advertisement

Some FBN Holdings shareholders protested after Otudeko purchased 4,770,269,843 units of FBN Holdings’ shares through his Honeywell Group.

The purchase brought the stake held by the company in the premier bank to 13.3 percent.

Advertisement

However, a few days after the purchase, Ecobank wrote a letter to FBN Holdings, asking the bank to reject Otudeko’s bid to become its largest shareholder.

In July 2023, the Securities and Exchange Commission (SEC) said it was investigating the acquisition of 4.77 billion shares of FBN Holdings by Otudeko.

Advertisement

On January 31, 2024 , First HoldCo appointed Otedola as the new chairman of its board.

Advertisement