BY FOLORUNSO FATAI ADIS

Burton Gordon Malkiel, the renowned American economist and author of A Random Walk Down Wall Street, once said: “A bubble starts when any group of stocks, those associated with the excitement of the Internet, begin to rise. The updraft encourages more people to buy the stocks, which causes more TV and print coverage, which causes even more people to buy, which creates big profits for early Internet stockholders. The successful investors tell you at cocktail parties how easy it is to get rich, which causes the stocks to rise further, which pulls in larger and larger groups of investors. But the whole mechanism is a kind of Ponzi scheme where more and more credulous investors must be found to buy the stock from the earlier investors. Eventually, one runs out of greater fools.”

Reading that, one might think Malkiel had Nigerians in mind.

From (un)real estate ventures to fake farming businesses, Ponzi schemes in Nigeria are evolving and multiplying. As business expands, so does deceit. Claiming your online investments are safe is now an extreme sport. Many Nigerians, bless our hopeful hearts, are Disney-level optimists, leaping from one abusive investment relationship to another, never pausing to learn.

Advertisement

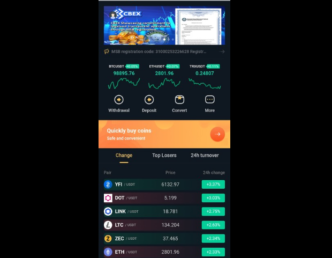

We have seen this show before. MMM collapsed. MBA followed. Yet, people still summoned the courage to invest in CBEX? Farming schemes were the next bait. Eatrich Farms came. Then Titan Farms. When funds vanished into thin air, victims suddenly found their voices. That is when many of us first heard of Chinmark.

Over a billion naira reportedly vanished in a food storage scheme run by one Ovaioza. Investors groaned. Again, heartrending. Gullibility. Greed.

Just days ago, I opened Facebook and was flooded with new waves of complaints. I tried to scroll past them, but a post about CBEX arrested my attention. My heart sank. Why do we keep falling for this?

Advertisement

True, advertisements can lie. From flashy branding and staged success stories to influencers peddling personality appeal, schemers know how to package poison. But at some point, we must stop drinking it.

Poverty is painful. Its bouts of bitterness are deep and relentless. In desperation, the poor are often willing to do the unthinkable. Ponzi schemes masquerade as shortcuts to liberation, but they’re traps.

Here is the painful truth: Ponzi is a marriage between crooks and the greedy, officiated by self-serving influencers and enablers. On social media, giveaways are the bait. But Dangote, Rabiu, Adenuga, Otedola, the real moguls, don’t do online giveaways. When I see startup CEOs splashing millions on “generosity” instead of reinvestment, I don’t see kindness. I see a red flag. I’m not against giving. But wasteful giving by someone building a brand? That is not generosity. That is a cover-up.

Given the scale of fraud in Nigeria, one would hope we have learnt our lesson. But hope is not a strategy. It is time for our financial regulatory agencies to step up, clamp down, and hold these charlatans accountable. If they don’t, despair will continue to fester, and some victims may spiral into irreversible tragedies.

Advertisement

Folorunso Fatai Adisa, media and communication specialist, writes from the United Kingdom and can be reached at [email protected].

Views expressed by contributors are strictly personal and not of TheCable.