When Olayemi Cardoso, the governor of the Central Bank of Nigeria (CBN), took the stage at the Lagos Business School, he set a thoughtful tone for what would become a landmark policy conversation. The occasion marked the inaugural edition of the CBN Governor’s Annual Lecture Series — part of the bank’s new knowledge acceleration and thought leadership initiative.

The initiative is designed to strengthen collaboration between the CBN and Nigeria’s leading academic and business institutions. It aims to create a platform where policymakers, scholars, industry leaders, and students can engage in deep, evidence-based discussions on the issues shaping Nigeria’s economic future.

Against that backdrop, Cardoso’s address, his first in the series, offered an honest reflection on the CBN’s recent reforms, the challenges of monetary management, and the path to rebuilding credibility and stability in Nigeria’s economy.

His reflections offered a blend of humility, technical insight, and a call to the next generation to redefine leadership through integrity and innovation.

Advertisement

1. Credibility as the foundation of reform

Cardoso’s most persistent theme was credibility. He described it as “the most valuable currency” any institution can hold — an assertion that reveals the philosophical core of his tenure. Upon taking office in 2023, he confronted a credibility deficit that had eroded confidence in both monetary policy and financial governance.

His early move to clear a verified foreign exchange backlog of over $7 billion — despite the fiscal burden — was a deliberate act of institutional restoration. It sent a powerful message to international markets that Nigeria would honour its commitments, regardless of short-term cost. The governor admitted he “had no idea” initially how it would be done, but viewed it as a reputational investment rather than an optional reform.

Advertisement

The results are visible. The nation’s foreign reserves have climbed above $42 billion, investor sentiment has improved, and Nigeria’s sovereign credit ratings are trending upward. In a global investment environment where perception shapes participation, Cardoso’s strategy of restoring credibility may be his most consequential reform.

2. A return to monetary orthodoxy

Perhaps the most significant policy shift under Cardoso has been the return to orthodox central banking. The CBN has pulled back from direct deficit financing and re-anchored its focus on price stability — the cornerstone of monetary discipline.

Between 2023 and 2025, the monetary policy rate was raised by more than 800 basis points, a move designed to curb excess liquidity and temper inflation, which had peaked near 35 percent. The results are encouraging: inflation has moderated to around 20 percent and continues on a disinflationary path.

Advertisement

By halting unorthodox fiscal interventions and returning to statutory limits on government financing, the CBN has reinforced the principle that central banks cannot serve as fiscal substitutes. This shift, though painful in the short term, is laying the groundwork for sustainable stability and investor trust.

3. Restoring confidence in the foreign exchange market

The governor’s foreign exchange reforms represent a structural recalibration of Nigeria’s monetary framework. The introduction of a willing buyer, willing seller system and the unification of multiple exchange rate windows have eliminated long-standing arbitrage opportunities that distorted the market.

Additionally, the CBN’s deployment of a B-matching electronic system now allows market participants to see exchange rates in real time — an unprecedented step toward transparency in a historically opaque space. This reform not only enhances price discovery but also strengthens the naira’s credibility by aligning it more closely with market realities.

Advertisement

Cardoso emphasised that Nigerians no longer need to “know somebody” to access foreign exchange — a direct rebuke of the patronage culture that once plagued the system.

4. Stability, growth, and a measured optimism

Advertisement

While acknowledging that “life remains hard for many Nigerians”, the governor presented what he described as a “discernable turning point” in the macroeconomic landscape. Inflation is trending down, GDP growth stood at 4.2 percent in the last quarter, and the naira is showing early signs of stabilisation.

Investor appetite, both domestic and international, is rising. Cardoso referenced growing engagement from global investment houses such as BlackRock as evidence that Nigeria’s credibility and policy consistency are being noticed abroad.

Advertisement

Cardoso’s economic outlook is cautiously optimistic. He believes that through credible policy actions and disciplined leadership, Nigeria’s economy can achieve sustainable recovery. His one-word forecast for the nation’s future is “bright”– which captures both the promise and the challenge of President Tinubu’s administration approach.

5. Strengthening the banking system and expanding inclusion

Advertisement

Cardoso’s speech reaffirmed the CBN’s dual focus on financial system resilience and inclusion. The ongoing bank recapitalisation drive aims to position Nigerian banks to finance large-scale industrial and infrastructure projects while maintaining strong balance sheets.

Simultaneously, access to finance is expanding through mobile and agency banking networks, raising financial inclusion from 56 percent in 2020 to over 64 percent by 2025. This is particularly critical for small businesses and underserved populations that remain at the periphery of the formal economy.

6. Transparency and institutional accountability

Cardoso has placed transparency at the heart of the CBN’s renewed credibility drive. The resumption of publishing audited financial statements after years of opacity, public release of net reserve figures, and live monetary policy committee (MPC) briefings mark a cultural shift toward openness.

He views public communication not as an afterthought, but as a core policy tool. “You cannot over-communicate in monetary policy,” he said during a fireside chat. This approach helps demystify central banking, promotes accountability, and aligns the institution with global best practices.

In the governor’s framework, transparency is both a signal and a safeguard — it builds public trust while keeping policymakers grounded in evidence-based decision-making.

7. The digital transformation of central banking

In perhaps one of the most forward-looking sections of his speech, Cardoso emphasised that the future of monetary policy will be shaped by technology. The CBN is embracing digitisation and artificial intelligence (AI) not only as tools for efficiency but as instruments of accountability.

The institution now operates largely as a paperless office, and its board of directors recently held a retreat dedicated entirely to AI and digital transformation — signaling change from the top.

Beyond internal modernisation, the CBN is also collaborating with the Securities and Exchange Commission (SEC) to craft a regulatory framework for crypto-assets and digital currencies. By integrating innovation within a controlled environment, the bank aims to strike the right balance between technological progress and systemic stability.

This pragmatic engagement with digital finance represents a marked shift from the earlier regulatory hesitation that left vast sections of the fintech ecosystem in uncertainty.

8. Cultivating next-generation leadership

One of the most inspiring segment of the governor’s address was his direct appeal to young Nigerians. With over half of the country’s population under 30, he positioned youth as both the beneficiaries and custodians of Nigeria’s future.

He urged them to “protect their credibility” as their most valuable personal asset, to persevere through challenges, and to embrace leadership not as inheritance but as transformation. His commitment to establishing mentorships and internship opportunities within the CBN underscores a deliberate effort to bridge generational gaps in leadership and governance.

He also issued a clear invitation to young people from all academic fields, urging them not to be intimidated but to consider a career at the bank, where a broad range of skills is essential to solving complex national challenges. Cardoso directly dismantled the misconception that the CBN is an exclusive club for finance and economics experts, demystifying the institution for a wider audience.

As he put it: “And that is why contrary to what you may think, you’ll find that there are people who work in the central bank who have multi-disciplinary skills. They’re not all economists. They’re not all finance people… I don’t want anybody to be dissuaded into thinking that it is such a complex institution that you may not have the skills.”

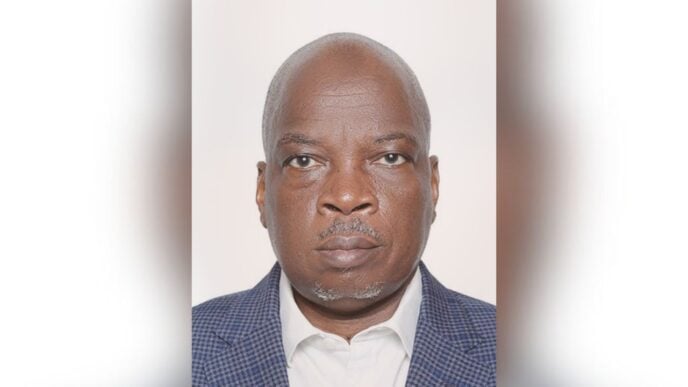

Oyalowo is the executive director of finance and administration at the Ogun-Osun River Basin Development Authority (O-ORBDA).

Views expressed by contributors are strictly personal and not of TheCable.