Report: Only 14% of climate finance from developed nations reached Africa in 2020

A recent report by Climate Policy Initiative (CPI), an analysis and advisory organisation, shows that in 2020, Africa got 14 percent of the total finance it needs to manage the impact of climate change.

According to the report, which was released on Thursday, while the climate finance needed in Africa is estimated at $250 billion per year, only about $29.5 billion was mobilised for Africa in 2020.

In addition to COVID-19 recovery and the Russian invasion of Ukraine, the report finds that the mid to long term effects of climate change are expected to further depress the GDP of most African nations by two to five percent annually by 2030.

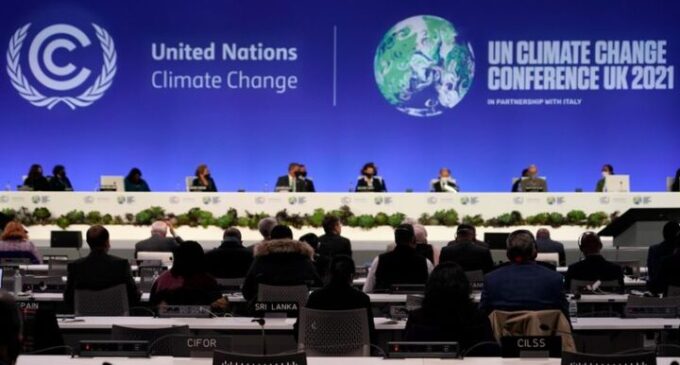

Despite promises by developed countries, they have not been able to meet their pledge of a yearly $100 billion, made in 2009, to help poorer countries.

The report added that for Africa to harness climate investment opportunities, it needs to strategically attract private investments.

“The current amount of climate finance flowing to Africa is simply not fulfilling the massive needs of the continent,” the report reads.

“While climate finance needs in Africa are estimated at USD 250 billion per year, total climate finance mobilised in the region in 2020 was only USD 29.5 billion, only 14% of the amount needed.

“Harnessing climate investment opportunities in Africa will require innovation in financing structures and strategic deployment of public capital to ‘crowd-in’ private investment at levels not yet seen.”

The report listed barriers to climate investments in the continent to include lack of enabling skills, infrastructure, data and financial markets depth, governance issues, and currency risks

For governance barriers, it stated that these barriers are related to “the stability of national or subnational political environments, the strength of legal and regulatory frameworks, and the complexity of administrative processes in the country where the project is based”.

“Political instability and weak regulatory frameworks inhibit long-term investment planning, while inefficient or corrupt administrative processes can significantly inhibit business operations and constrain finance at the project-level,” the report reads.

“While these barriers are real, the perception of risk linked to investments in the African continent is often aggravated by a limited understanding of national contexts by private investors.

“This may end up steering their capital toward other markets – perceived as safer – hence missing potentially profitable investments opportunities.”

There are no comments at the moment, do you want to add one?

Write a comment