In a 2018 interview, Peter Obi said he invested $20 million in International Breweries on behalf of Anambra state as a governor.

Obi’s claim was in response to questions on economic development, Anambra politics and his presidential ambition.

“… Anambra state is the single-highest shareholder in that facility. I invested in it, over $20 million,” Obi had said.

“It is worth almost $100 [million] today. That’s what government should do.”

Advertisement

TheCable had previously fact-checked some of the claims.

Chukwuma Soludo, governor of Anambra, also debunked a recent statement ascribed to him regarding the investment.

International Breweries (IB) Plc is a subsidiary of the world’s largest brewer, Anheuser-Busch InBev (AB InBev) — a multinational drink and brewing giant based in Leuven, Belgium.

Advertisement

In its 2021 audited financial statement, the company said it holds 43 percent economic interest in International Breweries Plc, a publicly listed company in Nigeria.

According to a report by The Nation, AB InBev merged its Nigerian operations under a single corporate entity in 2017. It had three indirect Nigerian subsidiaries — International Breweries Plc, Intafact Beverages Limited and Pabod Breweries Limited. SABMiller Nigeria Holdings BV — another subsidiary of AB InBev — was also a major stakeholder in Intafact and Pabod.

ANAMBRA’S INVESTMENT

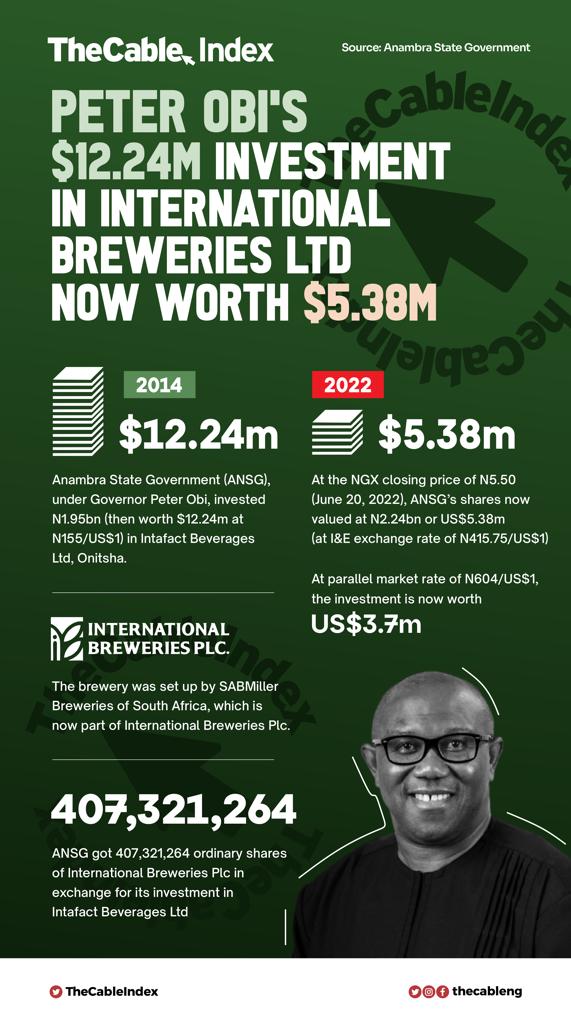

In a statement made available to TheCable on Tuesday, Ifeatu Onejeme, Anambra’s commissioner of finance, confirmed that Peter Obi’s administration invested the sum of N1,955,535,247.00 (an equivalent of approximately $12,616,356.43 at the then average CBN exchange rate of N155.00/$1) in Intafact Beverages Limited, a green-field brewery set up in Onitsha by SABMiller Breweries of South Africa in 2012.

Advertisement

Onejeme added that the state government still holds 407,321,264 ordinary shares of International Breweries Plc in exchange for the Intafact Beverages Limited investment.

“Based on the NGX closing price of N5.50 as of 20/6/22, these shares were valued at N2,240,266,952 on that date,” the statement reads in part.

“Based on the Central Bank of Nigeria I&E exchange rate of N415.75/US$1.00 on same June 20, 2022, this investment was valued at an equivalent of approximately US$5,388,495.37 (and at N604/$1.00 parallel market rate, only US$3,709,051.24).”

Advertisement

IB PLC’S SHAREHOLDERS & THEIR CURRENT STAKES

Checks by TheCable showed that International Breweries has two major shareholders with stakes above 5 percent. The highest shareholder is AB INBEV Nigeria Holdings BV with 72.03 percent followed by Brauhaase International Management GMBH with 8.85 percent. These details are contained in the company’s financial report dated March 2022.

Advertisement

- AB INBEV NIGERIA HOLDINGS BV — 78.44%.

- BRAUHAASE INTERNATIONAL MANAGEMENT GMBH — 8.85%

- FREE FLOAT — 11.03%.

Further checks showed that these individuals/ special purpose vehicles (a subsidiary company that is formed to undertake a specific business purpose) are part of the company’s minority stakeholders. They include:

- Olugbenga Awomolo – 1.24%.

- Michael Onochie Ajukwu – 0.27%.

- Igwe Nnaemeka Alfred Achebe – 0.15%.

- Akintoye Sunday Omole – 0.01%.

- Peter Nwokike Anugwu – 0.02%.

According to its financial records, International Breweries Plc returned negative bottom-line figures in the last three years. These are mainly due to high operational costs, FX fluctuations and supply chain constraints.

Advertisement