A farm | File photo

The first time Akinwunmi Gbenga, an architect, got interested in investing in the rapidly growing agritech sub-sector was in December 2019. As the year drew to an end, one of his resolutions for 2020 was to dedicate a portion of his monthly paycheck to agritech. Many around him had been investing for years and were consistently making tidy returns. To Akinwunmi, this was enough evidence that it was a profitable and reliable investment opportunity, hence he was all set to plant his money and wait for it to yield fruits.

Just before he could commit, the COVID-19 pandemic struck and consequently, cracks began to emerge in the business structure of some agritech companies, which thousands of middle-class Nigerian youths have come to rely upon as safe havens for investing their modest incomes.

In April, worrying posts began to surface on social media that Thrive Agric, one of the most popular agritech companies in the country, had defaulted in paying investors.

By October, it had become public knowledge that a number of agritech companies were owing investors. It was so rampant that a list tracking the performance of agritech companies is now compiled and updated on Nairaland, a Nigerian internet forum.

Advertisement

This, to Akinwunmi, was a strong indication that he had dodged a bullet. But unbeknownst to him, several agritech companies were doing just fine and able to deliver on their promise to investors. However, due to the new nature of the agritech investment structure, there is no regulation to ensure that investors’ funds are safe, hence some companies find themselves faltering.

Solving Nigeria’s food problems with technology

The idea behind agritech companies is simple; gather funds from willing investors through a crowdfunding process, make those funds available to farmers to scale up their operations (or in some cases, the agritech company does the farming), ultimately sell the harvest and share the profit with investors.

On paper, it seems like a win-win situation for everyone; investors get good returns on their investments, the problem of poor access to funds for farmers is eliminated and food production swells enough to feed the large population. You can even throw in foreign exchange earnings for the country if the agri-tech company is able to export its harvest.

Advertisement

There is, however, one problem; who guarantees the safety of investors’ funds?

Half-truths by Agritech companies

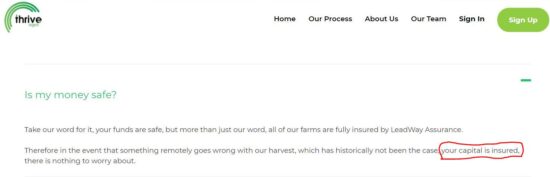

Information provided on the website of various agritech companies claims that invested funds are insured.

“Take our word for it, your funds are safe, but more than just our word, all our farms are fully insured. Therefore in the event that something remotely wrong with our harvest, which has historically not been the case, your capital is insured, there is nothing to worry about,” the insurance segment of Thrive Agric’s website previously read.

By assuring investors that “your capital is insured,” the company suggested that no matter the circumstance, their funds invested will remain unscathed.

Advertisement

It wasn’t until various companies started defaulting on payments that a small technicality was made known to investors — the funds are not insured, the farms are.

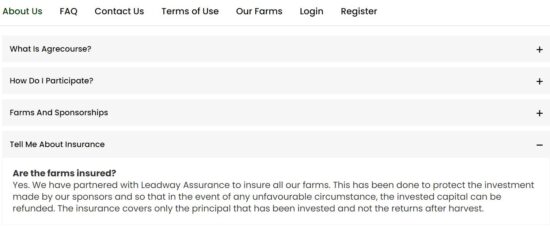

Agritech companies like Menorah Farms and Agrecourse (image below) also claimed to have insurance without stating explicitly if the insurance covers the total principal contributed by investors or funds that are actually invested in farms.

Ayoola Fatona, Leadway’s head of agric and micro insurance, bemoaned the fact that various agritech platforms use insurance protection claim to lure investors.

“The only challenge we have encountered with some of the Agritech platforms is their inability to properly inform the investing public concerning the level and limit of insurance protection we are providing for them which is limited to their farm assets and do not extend to the investors’ ROI and capital when there is a business failure,” he said.

Advertisement

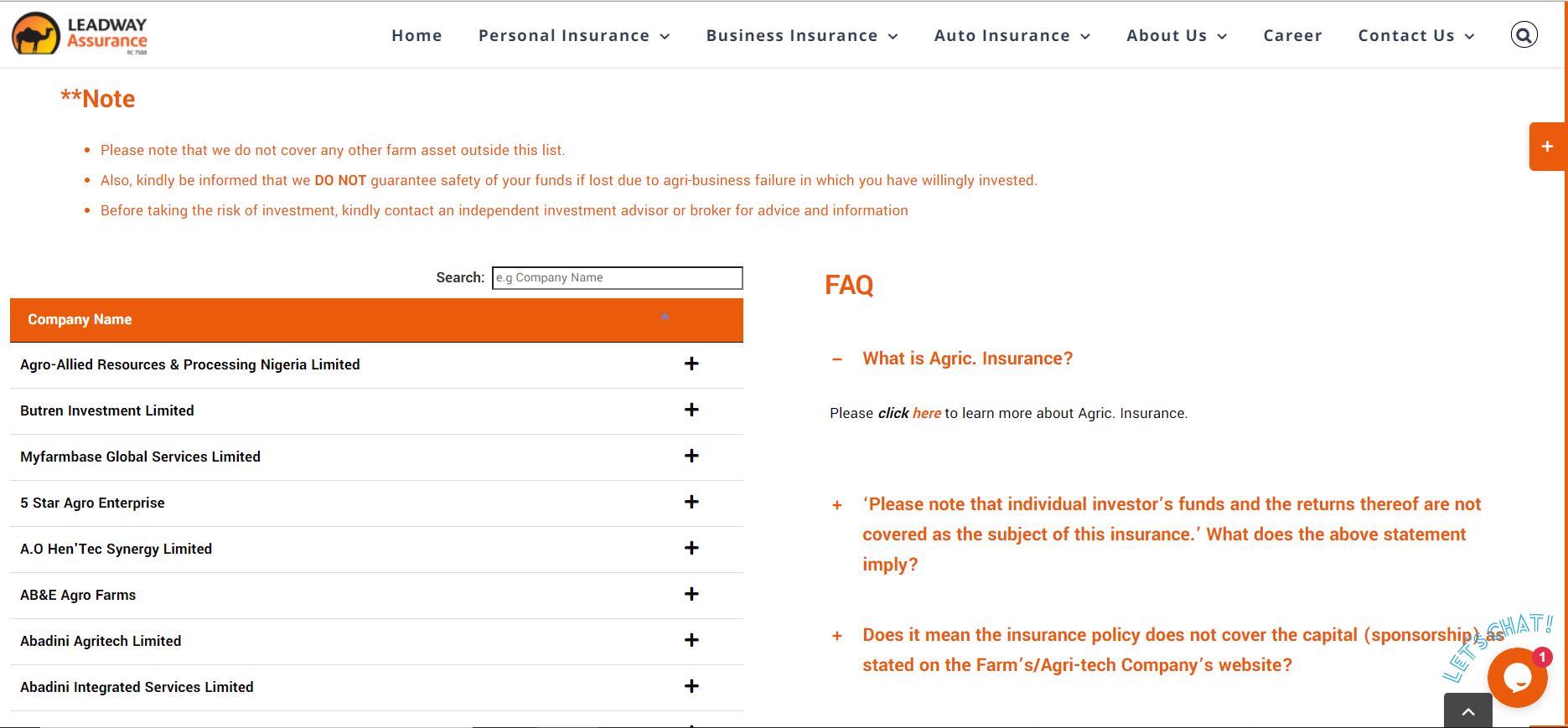

“Some will also insure a section of their farm assets with Leadway and they will make claims on their websites that all their projects are insured with us. In order to mitigate these challenges, Leadway created a portal where both existing and potential investors verify any farms that are claimed to be insured by these companies.

“On this platform, the investing public is privileged to see the type of project, location of the project and the value of the project.”

Advertisement

Full disclosure

After the Thrive Agric default incident, Leadway Assurance, which appears to be the choice insurer among agritech companies, updated the information on their agricultural insurance section.

In the now-updated frequently asked questions section of the website, Leadway Assurance says it “only provides cover for risks to the insured farm and not on individual investor’s funds and the returns”.

Advertisement

Simply put, if Mr A invests N100,000 in a snail farm offered by FarmX and the actual amount invested in the snail farm is N70,000, the insurance package can only be linked to N70,000.

Also, Mr A cannot approach the insurer directly for any claims in the event of a fire outbreak or natural disaster (coronavirus not included).

Advertisement

The insurer also says it does not secure individual investments with agritech companies in the event that an investor wishes to secure the investment already made.

How can investors ensure the safety of the total investment?

“Not all risks are insurable,” Fatona explained.

“In insuring the farm assets of these platforms, in line with insurance principles, only pure risks are insurable. These are risk categories that cannot be controlled and have two outcomes: complete loss or no loss at all. These situations cannot be predicted are beyond anyone’s control

“However risks that are not pure losses because they are not accidental to farming/production is not insurable as they are classified as speculative risks and cannot be easily quantified by insurance companies.”

When asked if there could be a change in the current realities and whether the total funds invested can be insured, he said: “Presently there are no products in markets to insure speculative risks. However if products are eventually deployed to mitigate them, it will longer be referred to as Agric. insurance but money or credit bond insurance”.

“The credit bond insurance is an arrangement wherein cases of default, the beneficiary (investor) can claim directly from the insurance company the money invested. Credit bond in our clime is a highly volatile risk with attendant moral hazards and as such most insurance companies are not willing to underwrite the risks in their books at the moment.”

Not where we used to be

As for the likes of Thrive Agric, the default experience, although bitter, has been a learning curve. A few months after the incident, the company changed its management, with Adia Sowho, former director of digital at 9mobile, appointed CEO to steer the ship through the stormy weather.

TheCable understands that since she came on board, ThriveAgric has commenced repayment, having placed investors on a turn-by-turn queue.

Chinwe Uhiara was one of those affected by the delayed payment. She invested in a rice farm in January 2020, and her investment was meant to mature in October. However, she did not get her returns until December 28.

“I have been investing in these agritech companies for three years now but 2020 was different. I thought the pandemic would affect the investments, however, we kept receiving updates about the farms so I was calm,” she said.

“It wasn’t until the investment matured that I was told we would not be getting our payments as at when due. Thankfully, I got my money including the return on investment some days ago.”

The high-risk nature of agricultural ventures made it a no-go area for conventional insurers in the 90s, leading to the creation of the Nigerian Agricultural Insurance Corporation (NAIC) in 1987 to bridge the gap.

Now, mainstream insurance companies are open to the idea of insuring agricultural ventures but this shift can only be expedited if there’s transparency on the part of the agritech companies in their dealings with investors.