The Central Bank of Nigeria (CBN) says it has come up with strategies to mitigate the impending food crisis occasioned by the crisis in Russia and Ukraine.

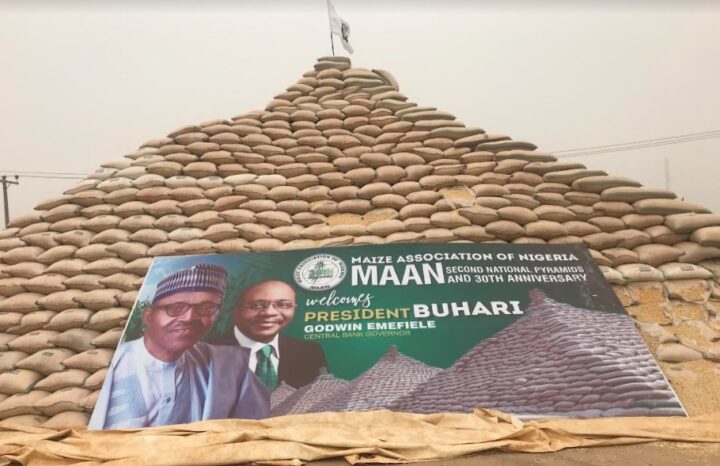

Godwin Emefiele, CBN governor, disclosed this on Thursday in Kaduna during the unveiling of maize pyramids under the CBN/Maize Association of Nigeria’s anchor borrowers’ programme (ABP).

Yila Yusuf, director, development finance department at CBN, represented Emefiele at the event.

TheCable had reported that the escalation of geopolitical tension in Russia-Ukraine would lead to a hike in food prices, especially on commodities that both countries export to Nigeria.

Advertisement

Speaking at the event, Emefiele said the volume of maize pyramids in Kaduna were intended to serve as stock for the strategic maize reserve (SMR) to be released immediately to major millers.

He said the apex bank is committed to financing 600,000 hectares as the farming season approaches.

“Our strategy is hinged on improving productivity by providing more funding for the anchors to enable them to utilise high-quality inputs and good agronomic practices to boost output,” the CBN governor said.

Advertisement

“Bringing recent happenings globally into perspective, two of the top ten exporters of maize (Argentina and Brazil) experienced droughts in 2021, while another two (Ukraine and Russia) are at war.

“This will certainly impact on maize supply globally and drive prices northwards.

“Consequently, we have planned a more robust and timely wet season to commence in April 2022 for maize and other key commodities like rice, wheat, cassava, sorghum and soyabeans to mitigate the impending food crisis occasioned by the crisis in Russia and Ukraine”.

Emefiele said the growth of maize production in Nigeria had been largely due to the increase in hectares of cultivated land and not the yields per hectare before the ABP revolution.

Advertisement

“The yield prior to 2016/2017 in Nigeria was as low as 1.8MT/Ha, considered as the lowest among the top 10 maize producers in Africa, behind countries such as Egypt and South Africa where the yields are 7.7 MT/Ha and 5.3MT/Ha, respectively,” he said.

The CBN governor further explained that the low yield resulted in the country’s inability to meet the domestic and industrial maize demand.

He said to address the yield challenge, the apex bank developed a framework for the participation of some seed companies in the 2021 wet season farming under the ABP to produce hybrid seeds that will guarantee a high yield for farmers.

Emefiele said the CBN is partnering with Flour Mills and technical experts to introduce good agronomic practices (GAP) through practical farm demonstrations to farmers and extension workers.

Advertisement

He said it will improve the yield of maize per hectare from an average of 2.5 tonnes per hectare to six tonnes per hectare.

“It is gratifying to note that the nation’s maize production as of date, is 12.2 million metric tonnes from 10.5 million metric tonnes in 2015 when the anchor borrowers’ programme commenced,” he said.

Advertisement

“This increased production is taken from the farmers as repayment for the loans and put in a strategic maize reserve.

“The Strategic Maize Reserve (SMR), which was established in December 2020 as a short-term measure pending the revitalisation of the Nigeria Commodity Exchange, is meant to moderate the price of maize in the country through strategic and phased releases to millers and poultry farmers.

Advertisement

“This was in line with the banks’ mandate of ensuring price stability and sustainable supply of maize to high demand industries.”

Advertisement