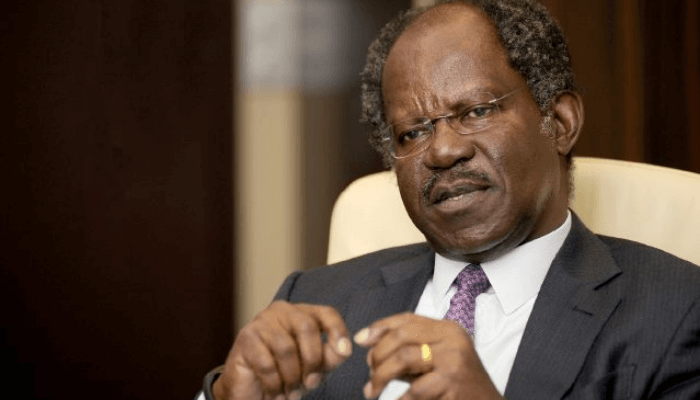

L-R: Ibukun Awosika, chair of GSG Nigeria, Muhammadu Sanusi, the emir of Kano, and Etemore Glover, the chief executive officer, Impact Investors Foundation

Muhammadu Sanusi, the emir of Kano and former governor of the Central Bank of Nigeria (CBN), says regulations should be created to compel banks to publicly disclose data on the number of loans disbursed to women-led businesses.

Sanusi spoke on Thursday at the launch of the ‘Gender Equity and Social Inclusion (GESI) Roadmap for Investing in Nigeria (2025-2035)’ by Impact Investors Foundation (IIF) and PwC Nigeria at the third Gender Impact Investment Summit (GIIS),

The former CBN governor said the regulation will encourage banks to improve loans to female-owned businesses.

“By regulation, banks, funds should be compelled to publish how many female-led businesses have they lent money to,” he said.

Advertisement

“Nobody’s forcing you to lend to women, but publish. Let the world see that you have lent to 10,000 companies and only five were led by women, and while your competitors are lending to 200.

“That in itself, just the discipline of thinking through and knowing that you have to disclose whether you’re woman-friendly or not, imposes that desire to go the extra mile.

“So these are the kinds of things I think we need to think about. And it’s not just women, it’s also people with disability.

Advertisement

“I think in the central bank, we actually had a policy, we went out and looked for people who were visually impaired.

“We looked for people who were disabled. We actually deliberately went out to look for them in order to have diversity.”

‘I CHANGED CBN RULE TO ENSURE MORE WOMEN OCCUPY DIRECTOR POSITION’

Sanusi revealed the institutional barriers he tackled to increase gender diversity at the apex bank, including changing the promotion rules to ensure more women could ascend to the position of director.

Advertisement

He noted that only four women became directors at different times throughout the bank’s first 50 years of existence, from its establishment in 1959 until he became the CBN governor in 2009.

“Two years into my tenure, I said we needed to have at least 30 percent of our directors being female. We went through the promotion process, when the results came out, there wasn’t a single woman,” Sanusi recounted.

“So I asked, why? I was told the women were not ready. In the entire bank, we couldn’t find women that could be directors, and they had rules that you had to be deputy director for three years.

“And because the promotions for women had been so slow, we didn’t have enough women who had been deputy directors for three years. So I said, fine. First of all, I changed the rule. I said, if you’ve been a deputy director for one year, you are eligible to put yourself up for consideration on merit.

Advertisement

“Then I decided that I would involve myself not in the promotion process, but in a pre-assessment. I called HR and said I wanted the CVs of all female deputy directors. One of the deputy directors I looked at had a degree in economics, a degree in accounting, three master’s degrees.

“She was a chartered accountant, not just Nigeria, but ACCA. She was top three in every risk-based examination in the bank every year. And she was in one small corner of a tiny office in Lagos with no visibility.”

Advertisement

Sanusi revealed that he placed the highly experienced woman he discovered in a tiny office, along with several other female staff, into traditionally male-dominated director positions such as banking supervision and risk management.

The former apex Bank chief noted that the success achieved during his tenure was largely attributable to the women.

Advertisement

‘GESI ROADMAP IS A BLUEPRINT FOR SIGNIFICANT SHIFT IN ECONOMY’

Etemore Glover, the chief executive officer (CEO) of the Impact Investors Foundation (IIF), said the GESI roadmap is not just a plan but a blueprint for a significant shift in Nigeria’s economy.

Advertisement

“The scale of the targets underscores our profound commitment to a future where no one is left behind. This incredibly exciting moment sets a powerful, decade-long course to democratize capital and transform our investment landscape for women, youth, and People with Disabilities (PwDs),” Glover added.

Also, Ibukun Awosika, chair of GSG Nigeria Partner and vice chair of GSG Impact, said the roadmap moves “us beyond aspiration to accountability”.

Awosika urged stakeholders not to only mobilise inclusive capital at scale but also embed GESI principles into every investment decision and policy, to enable the gaps to be closed, unlock Nigeria’s full economic potential, and ensure the country’s growth is truly equitable and transformative.

According to a statement by IIF, GESI Roadmap presents a clear, actionable plan with targets such as mobilising $8 billion in cumulative gender-inclusive capital and the launch of 40 inclusive financial products for women, youth, and persons with disabilities (PwDs).

Other targets are 90 percent integration of gender equity and social inclusion principles by General Partners, mobilisation of $1.5 billion domestic capital pools, and the enactment of 20 new policy and regulatory instruments, among others.

The launch of the roadmap also introduced the Nigeria Inclusive Capital Commitment 2035 campaign to drive actionable plans towards the GESI roadmap’s ambitious goals.