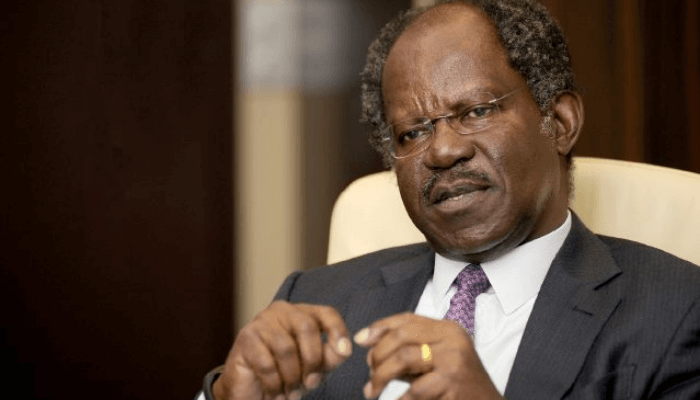

Emomotimi Agama, director-general of the Securities and Exchange Commission (SEC) says the slow pace of regional capital market integration is depriving West Africa of the scale of financing needed to close its vast infrastructure and development gaps.

Agama spoke in Abuja on Thursday at the experts’ meeting on validation of the WASRA charter.

Also the chairman of the West Africa Securities Regulators Association (WASRA), he said integration is “no longer a luxury but a necessity”.

“Each year of delay is a lost opportunity to mobilise resources for critical projects that can transform our economies,” the SEC DG said.

Advertisement

He said Africa faces an annual infrastructure financing gap of more than $100 billion, with West Africa alone requiring tens of billions of dollars to modernise transport corridors, upgrade energy systems, and build resilient digital infrastructure.

“Without integrated markets that pool liquidity and broaden investor participation, our governments and private sector will remain constrained, relying on limited fiscal space and expensive borrowing,” Agama said.

Drawing lessons from Europe and Southeast Asia, the SEC DG said harmonised capital markets were instrumental in driving economic transformation in those regions.

Advertisement

“The creation of a single market enabled European firms to access funding seamlessly across borders, boosting innovation and competitiveness,” he said.

“Closer to home, ASEAN coordinated standards and deepened financial cooperation, strengthening its resilience as a regional bloc.”

‘REGIONAL CAPITAL MARKET INTEGRATION WILL UNLOCK FUNDING’

Agama emphasised that West Africa, with over 400 million people and a combined gross domestic product (GDP) of about $800 billion, has even greater potential, but noted that “potential means little without decisive action”.

Advertisement

He said integration would unlock funding for infrastructure and also spur growth in agriculture, the digital economy, and youth employment.

“In agriculture, integrated markets can mobilise capital for value-chain development, agro-processing, and food security,” he said.

“In the digital economy, regional capital can support fintech scale-ups and broadband expansion, ensuring that West Africa fully participates in the fourth industrial revolution.”

Agama urged policymakers, especially finance ministers in the ECOWAS, to show political will and champion the WASRA initiative.

Advertisement

“Integration is not only about policy declarations; it is about practical collaboration and shared initiatives that deliver results for our markets and our people,” he added.

Also speaking, Wale Edun, minister of finance and coordinating minister of the economy, said the meeting marked “a significant step in the collective journey toward a harmonised regulatory framework” that would deepen cross-border investments and promote financial stability.

Advertisement

On his part, Peter Oluonye, acting director of private sector at the ECOWAS commission, said market integration requires harmonised rules, trading systems, and governance standards to break down barriers to capital flows.

Oluonye stressed that the region is in dire need of critical economic infrastructure projects that require huge capital investment.

Advertisement

He said the capital market is a major vehicle that should support this aspiration.

Advertisement