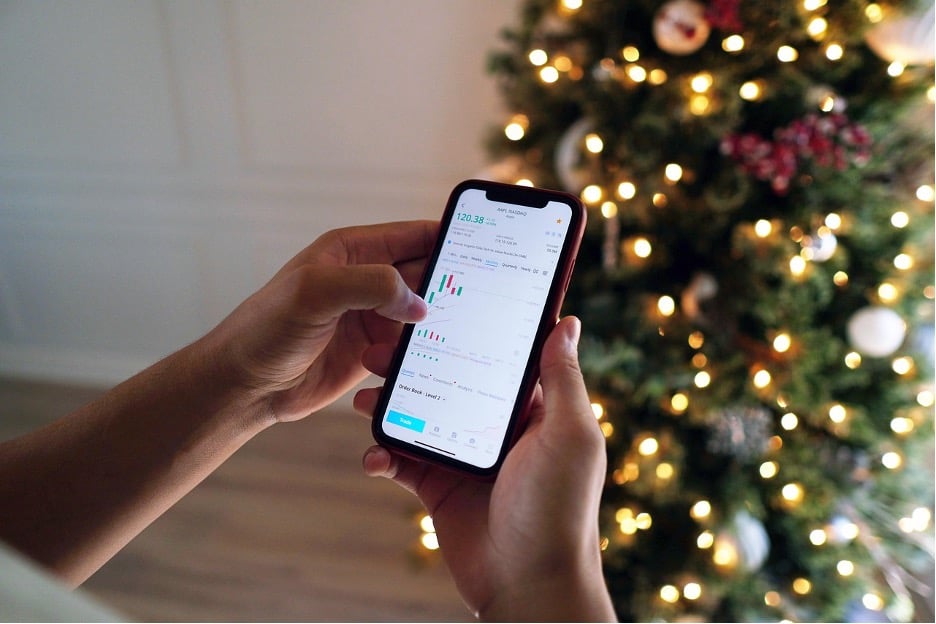

Across Nigeria, the rapid growth of mobile internet and digital payment systems has opened the door for ordinary citizens to participate in the global foreign-exchange market. Yet many first-time traders still struggle with the steep learning curve: understanding currency correlations, reading charts, and managing risk can feel overwhelming. Copy-trading communities—online networks that allow beginners to mirror the positions of experienced traders while exchanging ideas in real time—have emerged as one of the most effective ways to accelerate mastery.

For many novices in Lagos, Abuja, and Port Harcourt, platforms like HFM provide an accessible entry point to international markets while also acting as a gateway to vibrant Nigerian copy-trading groups on Telegram, WhatsApp, and proprietary social networks. By following seasoned traders whose strategies align with their goals, newcomers reduce the guesswork that so often leads to early losses.

The Rise of Copy-Trading in Nigeria

Nigeria’s youthful demographic—over sixty per cent of the population is under 25—gravitates toward peer-to-peer learning models. In the same way that millennials swap stock tips on Twitter or share crypto memes on TikTok, forex aspirants now crowd into copy-trading rooms where they can watch senior members open and close EUR/USD or GBP/NGN positions in real time. Local payment gateways such as Paystack and Flutterwave let traders fund their accounts in naira, removing the friction that once deterred participation. Combined with the Securities and Exchange Commission’s evolving guidelines on digital investment platforms, these factors have nurtured a thriving social-trading ecosystem that feels uniquely Nigerian.

How Copy-Trading Communities Accelerate Learning

- Live Exposure to Strategy Execution

Rather than study static textbook examples, learners see experts applying price-action setups during London and New York sessions. Over time, repetition cements pattern recognition. - Instant Feedback Loops

When a trade closes, mentors break down what went right or wrong in plain English. Immediate debriefs reinforce key lessons and prevent bad habits from hardening. - Shared Resources and Tools

Communities typically maintain curated Google Drive folders packed with recorded webinars, position-sizing calculators, and journal templates tailored to local market hours. - Positive Accountability

Public trade calls create social pressure to stick to stated risk limits. Peers quickly call out revenge trading or over-leveraging, fostering discipline.

Bridging Nigeria’s Knowledge Gaps

Unlike traders in older financial hubs who may have access to in-person seminars or brick-and-mortar prop-trading firms, Nigerians often rely solely on online content. Community leaders bridge this gap by contextualising global macro events—such as U.S. Non-Farm Payroll data or OPEC meetings—through a Nigerian lens. For example, when crude-oil prices spike, mentors explain potential impacts on the naira’s correlation with energy-export currencies like CAD or NOK, helping members anticipate volatility.

Moreover, many groups host weekend ‘power sessions’ in Pidgin English to make advanced topics—Fibonacci confluences, order-block theory, and liquidity grabs—accessible to traders who may feel intimidated by technical jargon delivered in foreign accents.

Choosing a Reliable Copy-Trading Community

Not every signal room delivers on its promises. Prospective members should evaluate:

- Transparency of track record

- Clarity of risk-management rules

- Ease of funding and withdrawal in Naira

- Depth of educational archives

- Responsiveness of moderators during high-impact news events

A community that openly publishes verified Myfxbook or MT4 investor passwords, limits drawdowns to five per cent per week, and offers round-the-clock support is far likelier to nurture sustainable growth than one that touts lofty monthly returns with no audit trail.

Best Practices for New Nigerian Traders

Adopt a Marathon Mindset

Copy-trading is a shortcut to understanding, not a guarantee of overnight riches. Allocate capital you can afford to lose, aim for consistent single-digit monthly gains, and compound slowly.

Study the Why Behind Each Trade

Blindly mirroring positions without grasping the rationale breeds dependency. Use every copied setup as a case study: what time frame, which confluences, and why was the stop-loss placed where it was?

Diversify Mentor Portfolios

Follow two or three traders whose styles differ—one breakout specialist, one swing trader, one news-event scalper—to see how varied approaches perform across market cycles.

Leverage Local Payment Solutions

Funding with naira reduces conversion fees. Prioritise brokers and communities that integrate Paystack or local bank transfers.

Stay Compliant

Monitor SEC Nigeria circulars and Central Bank guidelines to avoid unlicensed platforms masquerading as legitimate. Regulatory updates arrive often, and ignorance can prove costly.

The Broader Impact on Financial Inclusion

By shrinking the knowledge barrier, copy-trading communities democratise access to global capital flows. When a university graduate in Kano turns a modest stipend into supplementary income, the ripple effects touch family budgets, small-business funding, and even diaspora remittances. Women, historically underrepresented in speculative markets, now join female-only Telegram groups where they trade alongside peers without cultural stigma. Over time, this grassroots financial literacy could translate into a more sophisticated domestic investor base, supporting local stock exchanges and fostering entrepreneurship.

Conclusion

Emerging markets like Nigeria illustrate how technology and community spirit combine to flatten learning curves that once deterred would-be traders. Copy-trading networks, powered by mobile apps and social media, offer an apprenticeship model tailored to the realities of a fast-growing digital economy. When combined with disciplined risk management, ongoing education, and reputable platforms, these communities can turn steep climbs into smooth on-ramps, helping everyday Nigerians participate confidently in the twenty-four-hour world of forex.