Sterling Bank says it has scrapped the maintenance fees on personal accounts.

The decision is part of efforts to ease financial pressure on Nigerians and promote financial freedom, the bank said in a statement on Wednesday.

Account maintenance fees are typically deducted monthly from personal accounts.

The bank, in the statement, said the move aligns with its ongoing campaign to remove some of the most unpopular charges in the banking sector.

Advertisement

“This decision cuts at the heart of a revenue model that has long cost Nigerian customers dearly. In 2024 alone, tier-1 banks raked in over ₦650 billion from account maintenance and e-banking charges,” the statement reads

“Sterling’s move rewrites Nigeria’s banking rulebook while amplifying its bold stance: customers deserve freedom from too many deductions and the right to keep more of their hard-earned money.”

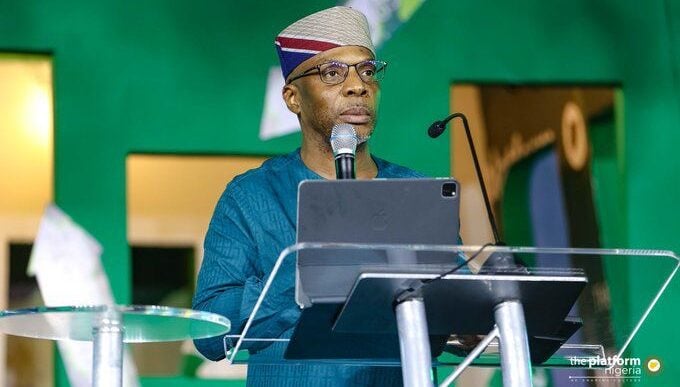

Abubakar Suleiman, managing director of Sterling Bank, said, “every fee we remove is one less barrier between our customers and true financial freedom”.

Advertisement

“This was the rationale behind eliminating transfer fees in April, and it is the same principle we uphold as we eliminate account maintenance fees,” Sulaiman said.

Obinna Ukachukwu, growth executive for consumer and business banking at Sterling Bank, said the initiative is about building lasting relationships that

fuel sustainable growth.

“We put transparency and customer value first, and in doing so, we are building a foundation that serves both our customers and Sterling’s future, Ukachukwu said.

Sterling said the cancellation comes six months after it eliminated transfer fees on its digital banking platform, OneBank.

Advertisement

The bank added that the reforms have collectively returned “billions of naira back into the hands of Nigerians”.

“In just six months, we’ve scrapped two of banking’s most unpopular charges. Zero transfer fees in April. Zero Account Maintenance Fees today,” the lender said in a post on X.

“This Independence Day, enjoy true financial freedom with OneBank.”

In April 2025, Sterling Bank announced the removal of transfer fees on all local online transactions.

Advertisement

This made the financial institution the first major Nigerian bank to eliminate the contentious charges for digital banking.

Advertisement