Whenever I hear some of our economists proposing a stronger naira, I wonder what economic development theory on which they are basing their argument. I’m not only strongly opposed to this kind of economics; I always try to do so with enough convincing evidence to prove my case.

To believe that the strength of any economy is dependent on the strength of its currency and, as a result, promotes its competitiveness only amounts to poor knowledge of the workings of modern international trade and why downward currency manipulation is the surest way to play to win in the economic competitiveness game.

To begin with, any proposal for a strong currency is never done with pro-real sector investment, pro-growth, pro-jobs or pro-poverty alleviation fully considered. The truth of the matter is that for any industrial economy to be continuously competitive or for any non-industrial economy to begin to industrialise, the first and the most important currency policy of such a country should focus on how best to make sure that imported consumer goods are priced out of its domestic market; it should later take the price war overseas by also making sure that, at international markets, locally made goods are made cheaper than goods made elsewhere. This is only made possible by making sure that the country’s domestic currency is constantly manipulated downward by those in charge of the country’s currency policy.

That’s exactly what China has been doing and it is exactly what has degenerated to the ongoing currency war between it and the US. It is why, if we too want to be truly industrial, we should make sure that not only do we cheaply produce most of the goods we consume, but also cheaply produce what many other countries have to consume. In other words, made-in-Nigeria goods should be continuously cheaper than those same goods made elsewhere.

Advertisement

But for this to happen, we all know that the value of the naira should be kept artificially lower not only than its real market value but, above all, lower than the value of most other major currencies, especially currencies of those economies which we intend to compete with.

This way, goods from these countries with strong currencies would be priced more expensively both in their own consumer markets and in Nigeria; while at the same time Nigerian-made goods get priced cheaper around the world. This will make Nigerian-made goods gain more consumer patronage than their competitors. As a result, millions of manufacturing jobs will be created in Nigeria while displacing competing firms wherever they may be found in the world.

The naira at N500 per dollar isn’t as bad as most Nigerians are made to believe by most of our economists. As long as we make access to official forex available to only importers of industrial inputs, mostly importers of essential raw materials and plant and equipment, imported inflation resulting from import dependency will never arise.

Advertisement

Carrying out this new forex policy is the single policy needed to lessen the pressure on our foreign reserve accounts because it discourages importation of goods that can be cheaply and easily made locally. With most importers of finished consumer goods denied access to official forex and also required to prove beyond doubt the legitimate source of their forex, certainly that will amount to making it difficult for those importers of cheap foreign-made goods to access forex, which will put a stop to the pressure such imported goods have on our foreign reserve accounts.

This will discourage the import of finished consumer products that tend to displace our infant industries and jobs. When we cheaply produce these goods locally, imported goods will be priced out in Nigeria. This is the only way import substitution industrialization will be made possible in Nigeria, especially with the goal to quicken the country’s industrialization to the extent that, within a short period of time, we too can begin to become one of the leading industrial economies in the world with millions of industrial jobs created along with millions of poor Nigerians lifted out of poverty and government revenue growing in such geometric progression.

This is what really happened in China. With such smart policy China created more than 600 million jobs and close to 900 million of its 1.4 billion people lifted out of poverty during the past 39 years of its economic revolution driven by import substitution. Since China adopted this policy of manipulating its currency yuan downward while making sure its competitors’ currencies are kept artificially high, Chinese goods have continued to be far cheaper than goods from these competitors. In this currency war, China has always beaten the US for more than two decades now.

To ensure that the US does not devalue the dollar which would amount to double jeopardy, China, rather than going to demand from the US to pay it its over $4 trillion in dollar foreign reserves, knowing full well that that would amount to the US printing more dollars (possibly exactly that amount) which would, in fact, amount to the very devaluation of the dollar, acquiring strategic US brownfield companies, important corporate buildings and resorts, farmlands, etc., remains the smartest thing China is doing without having to force the US to devalue the dollar.

Advertisement

That is the same reason why, in the meantime, making sure that going forward China’s exposure to the dollar is drastically reduced, China has since engaged in currency swaps with most of its major trading partners around the world. And with the currency swaps adoption, China is increasingly lessening its economy’s exposure to already battered dollar which is fast losing its global de facto reserve currency power – its collapse is only a matter of time. China rightly believes that when that happens, its yuan will eventually replace the dollar as the world’s reserve currency.

For Nigeria to get its economic development right this time round, Atiku should emulate President Franklin Roosevelt and Chairman Deng Xiaoping’s kind of nationalist economic activism. At least, he should follow the recent footsteps of Donald Trump who not only campaigned for “America First” but who has been practising his “American First” economic diplomacy. Personally, I don’t see anything wrong in a president prioritising the interests of those who gave him a mandate.

Even as President-elect, Atiku’s economic revival team should be mandated to come up with all the clear steps his administration would be taking in order to trigger the unprecedented economic revolution through diversification. All these steps will ensure that, for the first time in Nigeria, the economy is given a firm pathway toward industrialization.

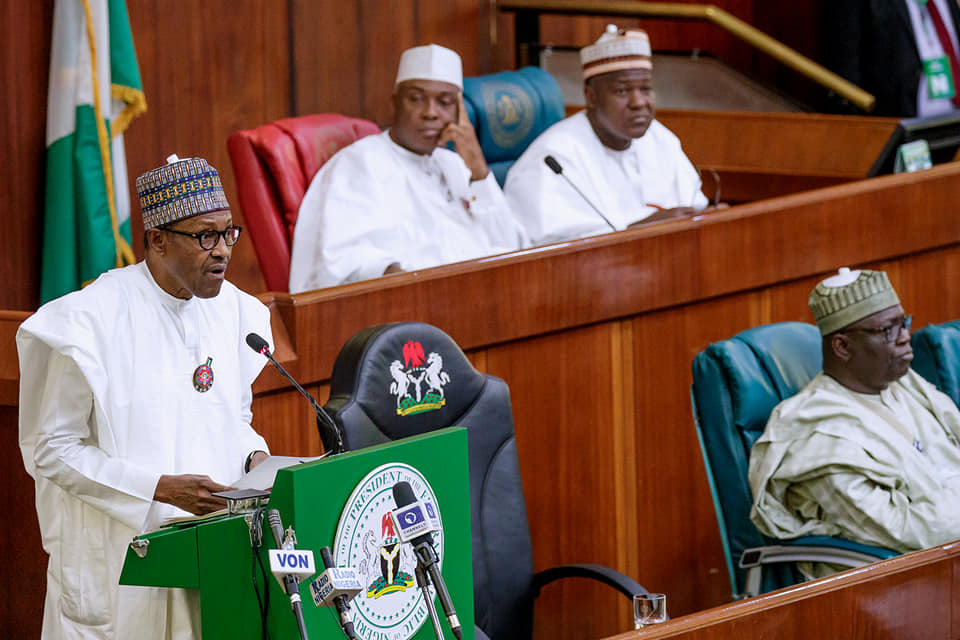

Among the quick steps his government should take in an effort to quickly ensure economic turnaround and creation of millions of manufacturing jobs for Nigerians during his first tenure will include a series of Executive Bills (EB) to be forwarded to the 9th Assembly once it is inaugurated.

Advertisement

The EB will include the 2019 Foreign Exchange Bill, the CBN 2007 Act Repeal Bill, the Nigerian Banking Regulatory Commission Bill, the Nigerian Industrialization Commission Bill, the Fiscal Sunshine Bill, the Fiscal Expansionary Bill, the Infant Industry Protection Bill, the Informal Sector Formalisation Bill, the Foreign Investment Regulatory Bill, the Nigerian Trade Diplomacy Bill, and the Local Content Amendment Bill.

Advertisement

Enwegbara, a development economist, writes from Abuja.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.