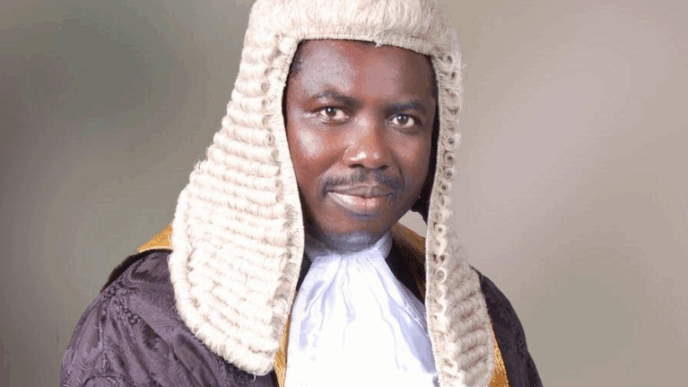

Bola Tinubu

Last week, the World Bank put out its assessment of president Tinubu’s economic policies and its impact on the people of Nigeria. The sum total of it was that 139 million Nigerians have been impoverished as a result and the outlook is that many more will fall below the poverty line in the coming months. In making the assessment the World Bank Country Director, Mathew Verghis while praising the efforts of the Tinubu in achieving stabilization, stated that ‘’However, despite these stabilization gains, many Nigerians are still struggling. Most households are struggling with eroded purchasing power. In 2025 we estimate that 139 million Nigerians live in poverty.’’

The World Bank report comes just after president Tinubu in his Independence day address to the nation engaged in his usual self-praise despite in contrast to the existing realities in the country. ‘’I am pleased to report that we have finally turned the corner’’, he crowed. ‘’The worst is over. Yesterday’s pains are giving way to relief’’ he stated to the obvious disbelief of the very Nigerians he was addressing.

So why has the World Bank given what amounts to a thumbs down to President Tinubu’s economic policies and its negative impact on Nigeria, a few days after the president claimed rather unconvincingly that things are improving? What is the World Bank trying to tell us about president Tinubu’s economic policies which many may not know and which the president’s spin doctors have been trying to airbrush with contrived terms and phrases?

In this analysis, for the purpose of clarity and better understanding, I will provide simple and straightforward explanations on the crisis and contradictions inherent in president Tinubu’s economic policies

which the World Bank’s latest report on Nigeria sought to point out to us.

Advertisement

The cornerstone of Tinubu’s economic policies is that Taxation spur the country’s growth and development. Such assumption may have been relevant when president was Governor of Lagos state because relatively the Lagos economy and Gross Domestic Product (GDP) powered by high levels of Internally Generated Revenue (IGR) is huge and uniformly concentrated in one contiguous enclave location. This is similar to what obtains in relatively small countries like Scandinavian nations where Taxes are drive the distribution of resources and services.

But in a larger Nigerian context that is at the lowest rung of development index on an aggregate level, the recourse to fiscal measures to run the economy will surely lead to negative consequences.

This is what the World Bank is trying to tell us. Essentially what the multilateral institution is saying is ‘’Yes Mr President, your chosen policy as conceived and implemented by you is working from the point of view of raising record revenues. But it is being done at the cost of impoverishment of more and more Nigerians who are having the living daylights squeezed out of them’’.

Advertisement

Moreover, what the World Bank implied but left unsaid is that the revenues generated from this massive and unreasonable tax drive on Nigerians has not been spent on industrial development and production to grow the economy. Instead the huge revenues generated by the tax drive has been spent on frivolities like luxury expenditures of the administration at the local, state and federal levels. And the Nigerian people who are the bearers of this heavy tax burden suffer a double whammy of taxation and lack of investment in services, employment and general economic growth and development. Ignore the abstract economic figures contrived to present a picture of economic progress reeled out by the administration personalities and its tribe of influencers; the World Bank and many who are able to see through this elaborately packaged façade know that president Tinubu’s economic policies are out of sync with the realities on ground and can never bring about the desired pathway for Nigeria’s economic development.

Let us measure how president Tinubu’s economic policies measure up against economic thinking and application.

Two main streams of economic thinking and application run in the world; Supply- side economics which focuses on removing totally or scaling down the taxes applied on the highest taxable concerns and individuals to spur supply and growth and the demand-side economics which government intervenes to create aggregate demand from taxation, employment and investment.

Under the Tinubu economic policy model, none of these two applies. Tinubu’s economic policies certainly does not go in tandem with the Supply- siders because it is based on massive taxation which serves as a disincentive to concerns and people with the capacity to invest in manufacturing and production. Thus faced with the heavy burden of taxes, they cannot invest in new ventures and are looking instead to scale down or totally scrap what they have. And because they cannot invest and produce, the effect is redundancies and unemployment.

Advertisement

We could say that Tinubu’s policies lean towards the demand-siders in his fiscal thrust. But unlike in countries where taxation leads to creating and sustaining efficient and reliable service provision, investment and employment, the thrust of Tinubu’s policies does not and cannot lead to investment in industrial production and provision of services. So, what in essence is Tinubu’s policies?

It is a mongrel economic model of tax and spend, raising revenues through a massive ‘’smash and grab’’ hoovering of the Nigerian people to fund the luxuriant living of dubiously entitled living of the privileged few. The Tinubu economic model belongs in the age of colonial subjugation where a colonizing power subjects its colony to various forms of taxation to fund their subjugation thereby impoverishing the people the more. What the World Bank is telling Nigerians in coded reference is that the Tinubu model is not designed to encourage investment in industrial production and public works infrastructure as happened in many countries. The fiscal policies of the administration is instead designed to tax Nigerians and transfer the revenues so raised to support the entitled living of a privileged few. And because it is a model leads and feeds luxuries and consumption, the government has to resort to more taxation and seeking for loans to continuously feed the habit like an addiction. The taxes will impoverish Nigerians now and the loans will commit our future and that of generations to come with a massive repayment burden that will cripple our future development as a nation.

Gadu can be reached via [email protected] and 08035355706 (Texts only)

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.