What if you woke up tomorrow to discover your rent had been doubled? Would you spontaneously adjust to it without pressure? What is behind the shocking rent hikes in many cities in Nigeria, in particular Lagos and Abuja? Inflation, right? As food and fuel prices soar, landlords in these cities are increasingly passing the heat onto tenants sharply, some demanding rent increases as high as 150% without any hindrance. A two-bedroom apartment in Lekki that once cost ₦1.5 million now goes for ₦2.2 million.

The housing vulnerability in Nigeria has reached alarming proportions, and the situation is not only a challenge for the economy but also a source of immense stress for ordinary Nigerians, many of whom struggle to keep up with rising rent prices and the declining quality of available housing. What was once considered a modest expense back then is now a significant portion of one’s salary, and the dream of owning a home seems increasingly out of reach for the majority in recent times. In Lagos, Nigeria’s commercial capital, the pressure on the housing market is severe.

The city is home to over 23 million people, and this population continues to rise as people flood in from all over the country in search of better job opportunities. However, the demand for housing far exceeds the available supply. As a result, rent prices have skyrocketed, and many young professionals are finding themselves in a difficult position.

A common experience for many in Lagos is spending more than half of their monthly salary on rent. The reality for a graduate in a mid-level job in Lekki or Ikeja means finding a one-bedroom apartment for anywhere between ₦950,000 to ₦1.5 million annually. Even then, the conditions are often manageable, with little access to basic amenities like consistent water supply, proper sanitation, or reliable electricity.

Advertisement

The situation in Abuja, the nation’s capital, is equally dire. While the city is still relatively newer in terms of development, rapid urbanisation has led to significant price hikes in the rental market. The upper-middle class and young families are particularly affected. Those who were once able to afford relatively comfortable housing in areas like Wuse, Garki, and Maitama are now struggling to find suitable living spaces within their budgets.

The absence of affordable housing options forces many to seek accommodations in the more remote and developing districts, which lack necessary infrastructure, further exacerbating the gap between affordable and livable housing. Even smaller cities across Nigeria are not exempt from housing vulnerability.

For instance, in cities like Benin, Enugu, and Ibadan, the rent situation is equally worrying. In these places, working-class families find themselves squeezed between the high cost of living and the insufficient housing infrastructure that doesn’t cater to the masses. Those who cannot afford the skyrocketing rents often resort to living in overcrowded conditions, with extended families or in single-room apartments that barely meet basic living standards.

Advertisement

The impact of Nigeria’s housing crisis is felt in both tangible and intangible ways. Families are often forced to make difficult choices between paying rent and meeting other basic needs such as healthcare, education, or saving for the future. As the cost of housing continues to rise, the socio-economic divide grows wider, creating a cycle of poverty that is hard to break.

Yet, while the situation seems terrible, there are steps that can be taken to alleviate the strain on the Nigerian housing market and improve rent vulnerability in urban centres. One crucial strategy is the support from the government for the implementation of affordable housing policies at the national and state levels. The government can partner with the private sector to incentivise housing developers to build affordable homes and also provide more regulation to the sector. Rent control measures could also be a powerful tool to curb the rising cost of rent only if the government play an important role as developer or partner.

For instance, setting limits on the percentage by which rent can increase annually could prevent landlords from raising rent indiscriminately, as they often do in response to inflation. Rent control measures must be carefully designed to avoid discouraging landlords from maintaining their properties. Moreso, proper zoning regulations like what Lagos State Building Control Agency (LASBCA)is doing should be encouraged to prevent haphazard building practices across Nigeria.

Finally, in my opinion, as urban populations continue to swell, the government and society must work together to create a housing system that ensures everyone, regardless of income, has access to decent living conditions. The housing crisis in Nigeria is not an insurmountable problem. With the right policies, community involvement, and investment in sustainable development, Nigeria can create a future where affordable, decent housing is within reach for all its citizens. While the journey will be long and challenging, the collective effort of the government, the private sector, and citizens can pave the way for a more inclusive and affordable housing market in Nigeria’s cities. Good luck!

Advertisement

How may you obtain advice or further information on the article?

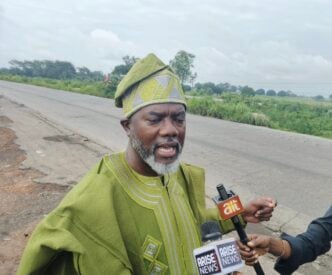

Dr Timi Olubiyi is an expert in entrepreneurship and business management. He is a prolific investment coach, author, columnist, and seasoned scholar. Additionally, he is a chartered member of the Chartered Institute for Securities and Investment (CISI) and a registered capital market operator with the Securities and Exchange Commission (SEC). He can be reached through his Twitter handle @drtimiolubiyi and via email at [email protected]

Views expressed by contributors are strictly personal and not of TheCable.