Street hawkers at the #EndBadGovernance protest in Lagos

BY ZUHUMNAN DAPEL

Recently, a former Nigerian president sparked a wave of national reactions with his statement: “I now feed by renting out my house in Kaduna.”

Many Nigerians interpreted his remarks in different ways. Some saw it as evidence that he had not stolen public funds to support a luxurious lifestyle after his presidency. Others, however, argued that he is a victim of an ailing economic system for which he is partly responsible, claiming that if a former president has to rely on rental income for survival, what does that say about the average citizen?

Regardless of how his statement is construed, the economic facts support the claim that the state of the Nigerian economy has worsened alarmingly compared to the past decade. The average living standard (GDP per capita) has fallen by about three per cent. The inflation rate rose from a single digit (less than 8%) in November 2014 to nearly 30% as of March 2025. Inflation, particularly concerning food prices, is deemed the biggest contributor to the current economic hardship in the country.

Advertisement

The youth are increasingly disenchanted. A clear sign that a nation is at a critical economic crossroads is when its citizens yearn for a return to the past rather than look to the future with hope. Paul Collier, in his book “The Bottom Billion,” remarked, “Development is about giving hope to the ordinary people that their children will live in a society that has caught up with the rest of the world. Take that hope away, and the smart people will use their energies not to develop their society but to escape from it.” Supporting this notion, Michael Clemens, a leading migration economist, stated, “There is no poor neighbourhood, city, region, or country on Earth that has developed in any meaningful way by trapping people there.” This describes the Nigerian situation well—Nigerians are leaving the country in droves.

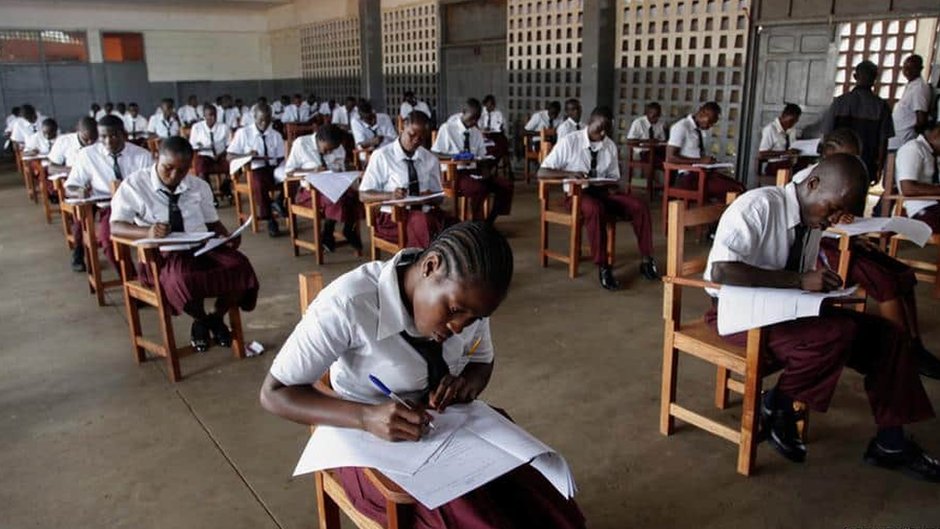

According to an Afrobarometer survey, over 35% of Nigerians are willing to relocate abroad if given the opportunity. The African Polling Institute reported that 70% of Nigerians aged 18-35 years expressed this desire, and by 2024, this proportion rose to over 80% among healthcare workers. Consequently, the number of Nigerian students in three foreign countries increased by more than 200% within a decade. The chart below stitches together the extent of ‘education’ migration.

Over the past five years, Nigeria has lost 16,000 medical doctors to migration. Worryingly, this loss reduces the country’s doctor-to-population ratio because it takes nearly a decade (accounting for ASUU strikes) to train a qualified medical doctor in Nigeria. Meanwhile, we face a crisis of internal migration of doctors, as Lagos and Abuja, the country’s most prosperous cities, have the highest concentration of medical professionals, not necessarily due to higher demand for medical services.

Advertisement

The primary driving force behind this mass exodus is a desperate escape from economic destitution.

The Golden Age

Nigeria’s golden decade—a period of remarkable economic success—has come and gone. This was during the 1970s when Nigeria was a lending nation, not a borrowing one. Oil prices were soaring. The country’s currency was the strongest in Africa, even stronger than the US dollar and comparable to the British pound. Inflation and unemployment were historically low, and average living standards were about twice as high as they had been in the 1980s and 1990s.

During this Golden Age, significant projects were executed: two federally owned refineries were established and operational, and eight federal universities were founded, staffed with experienced and foreign-trained academics. Nigerian students who lived through this decade—many of whom are still alive today—can attest to the quality of education, life, and career prospects during that time. The economy was thriving for the majority, and the security of lives and property was much better than it is today.

Advertisement

The Journey to the Gilded Age

The term “Gilded Age” was coined by American essayist Mark Twain to describe a period marked by great wealth and poverty, as well as political corruption. Nigeria’s transition from its golden age to its current state of economic discontent is a result of a combination of political instability (e.g., three heads of state in less than two years), poor economic policies, and widespread corruption across all levels of government.

When oil prices hover around $100 per barrel, Nigeria generates approximately $200 million per day in revenues from the global oil market. Who are the major beneficiaries of these proceeds? The answer is not straightforward.

About two decades ago, 58% of Nigerians were living in absolute poverty—around 70 million people who could not spend 98 naira ($1.25, adjusted for purchasing power parity) per person per day on food and other basic needs. This amount is enough to buy a light lunch, pay for two haircuts, or purchase half a gallon of petrol in Nigeria, but it is insufficient for a cup of coffee at Starbucks in the United States or Costa Coffee in the United Kingdom. Back then, there were no Nigerians on Forbes’ global list of billionaires. Fast forward to 2010, and the statistics worsened: the number of people living in poverty increased from 69 million in 2004 to over 100 million, while the number of billionaires rose from zero to two. By 2020, this figure had increased to five, with roughly half of the country’s population living below the poverty line. In 2010, 7 out of 10 Nigerians were considered poor by this standard.

Advertisement

The combined net worth of these billionaires is approximately $24 billion, averaging about $4.6 billion per person. In 2020, Nigeria’s average income, adjusted for the wealth held by billionaires, was $1,300—meaning the wealth of one billionaire is nearly equivalent to the total yearly income of over three million Nigerians. Thus, for every Nigerian who made it onto the Forbes list, about 22 million citizens fell deeper into poverty. Is this a mere coincidence? Does it seem reasonable that the creation of a billionaire in the country comes at the expense of over 20 million people sinking into poverty? It can be argued that the poorer the poor become, the richer the rich grow: billionaires, supported by skewed government policies, are amassing wealth at the expense of the impoverished.

Three of these billionaires attribute their fortunes to the oil business, while one credits telecommunications as their primary source of income. Yet, the oil industry is not performing optimally; until recently, over 80% of gasoline consumed in the country was imported, compounded by sporadic supply issues and long queues at local fuel stations. Additionally, internet services remain unreliable, and broad access to broadband is lacking. This raises an important question: how do these billionaires achieve their profits in a system where the market environment is dysfunctional, and the rules appear to be rigged?

Advertisement

This question reminds one of George Stigler’s assertion in “The Theory of Economic Regulation,” which holds that the state possesses a unique resource—the power to coerce—that is not shared with its most powerful citizens. The government uses this power to compel citizens to pay taxes and abide by rules. This coercive authority can be wielded in a way that benefits certain individuals or industries at the expense of others. Businesses often attempt to influence how the state uses its coercive power to “purchase” government products such as subsidies, control over competitive entry, regulation of product substitutes or complements, and price fixing.

It is important to clarify that amassing wealth is not inherently criminal, provided that the rules and policies governing the creation of billionaires are not perverted by government intervention that favours the super-rich. In a fair society, if the economic “pie” grows and the income of the richest increases, the level of inequality should not escalate rapidly. Ideally, billionaires should enrich themselves not through rent-seeking behaviour but by contributing to the expansion of the national economy, enabling the impoverished to escape the clutches of poverty.

Advertisement

One characteristic of the Gilded Age is the decline of public institutions, particularly the education system. The quality of public schools has deteriorated, paving the way for the rise of private universities (with the oldest founded in 1999) and exacerbating inequality in access to high-quality education and earnings.

Prof. Steve Okecha, a prominent critic of the deterioration of the education system and a notable observer of Nigerian tertiary institutions, describes the current situation as “An Ivory Tower with Neither Ivory Nor Tower.” In his latest book, he notes that “beyond the fanciful gates are horrible classrooms; slums called lecture theatres; dry taps, and empty chemistry laboratories.”

Advertisement

This should not come as a surprise to those who have been monitoring education spending in the country. In the aftermath of its peak days, there has been a continuous fall in the government’s investment in education. As a share of GDP, government expenditure on education dropped from over 3% in 1974 to less than 0.5% (0.3%) by 2022.

One significant outcome of a weakened education system is the lack of social mobility. Social mobility has been stagnant in Nigeria for decades, with high-paying jobs typically going to those who possess high-quality degrees. These high-quality degrees depend on a strong foundation of education, which in turn relies on high-quality primary and secondary schools. Unfortunately, students often struggle to obtain a solid educational foundation from Nigerian public schools today. As a result, families must invest in private education to secure these credentials. However, a high-quality private education requires substantial financial resources, creating a barrier for poor families. Consequently, children from affluent households continue to secure well-paid jobs, perpetuating widening inequality in opportunities in Nigeria.

As Nigeria aspires to join the ranks of other great advanced nations, it should consider how these countries operate their educational institutions. For instance, in the United Kingdom, some head teachers in primary schools earn higher salaries than elected officials, such as Members of Parliament (the equivalent of House of Representatives members in Nigeria).

A crucial factor that contributed to the bad economic and social outcomes was the collapse of global oil prices. Since the Nigerian economy has relied heavily on oil revenue for decades, the decline in oil prices has severely affected living standards.

Another indicator of Nigeria’s economic challenges is the inadequate investment in infrastructure and capital formation, which are vital measures of a country’s economic health. Depreciation of the nation’s assets (without replacement) signifies a potentially slower economic growth rate due to limited investment in future production capacity, which hinders long-term growth.

What can we do about the situation?

Rather than quibble about the past, Nigeria still has the opportunity to depressurise the situation – gather up its pieces, fix the rot in its economic foundation and build a prosperous economy. However, the path to achieving this is an uphill battle that requires a multi-pronged approach focused on economic revival and institutional reawakening.

A strong starting point for Nigeria is to work toward self-sufficiency in producing four major categories of goods that Nigerians consume the most: food items, building materials, pharmaceutical products, and clothing/footwear. This initiative should be led by the private sector, with the government playing both a complementary and supplementary role. For industries to function effectively, it is essential to address the energy crisis—power is necessary to energise the private sector, which can, in turn, drive growth and lift millions out of poverty.

Moreover, the government must ensure the independence of three key public institutions from the executive branch: the central bank, the national electoral commission, and the judiciary. These institutions are vital for the long-term success of viable economic policies.

If the central bank lacks independence, it cannot effectively combat inflation (the primary driver of the economic downturn), nor can it maintain economic stability. Decisions made by the central bank—such as printing or infusing extra cash into the economy (a process known as “quantitative easing), changing exchange rates, or lending money to the government—can be significantly influenced by political pressures. Historically, since 1999, the Central Bank of Nigeria has checked all boxes of a non-independent institution: its governors share the same regional or ethnic background as the president who appoints them, and there has been a frequent turnover in leadership, with four out of five CBN governors never serving their full terms of 10 years.

A country cannot progress if its national electoral commission is significantly biased. Election cycles serve as crucial opportunities for ordinary citizens to exercise their right to vote out and replace underperforming leaders. Without this mechanism, ineffective leaders will continue to impose detrimental economic policies on the populace. Unfortunately, this is far from the reality in Nigeria.

According to an EU report, between 2007 and 2023, there were a total of 4,982 post-election petitions and appeals filed following the announcement of election results across five general elections. This number indicates a lack of transparency in the electoral process.

If the ballot box fails as a means of achieving change, the next option for seeking electoral justice is the judiciary. However, if the judiciary is not independent, it may end up validating rather than correcting electoral errors and corruption.

Zuhumnan Dapel can be contacted via @dapelzg

Views expressed by contributors are strictly personal and not of TheCable.