Across the African continent, a silent crisis is unfolding: the rise of retirement poverty only a few have retirement security. From Lagos to Lusaka, retirement is becoming not a time of rest but a significant economic concern for the elderly, marked by overdependence on children and increasing poverty. Despite decades of service, countless Africans reach old age without savings, without a reliable pension, and without the means to meet basic needs, and this is a worrying concern. In Nigeria, for instance, like many other places in Africa, rising living costs have worsened the retirement outlook since 2020, with the COVID-19 pandemic.

This retirement poverty trend has become more visible than ever in Nigeria, where the experience mirrors that of many African nations. In countries like Kenya, Ghana, and Uganda, pension coverage remains low, and the quality of life for the elderly is declining, particularly after their meritorious service and business management years. While many factors contribute to this retirement poverty crisis, one issue stands out it is the growing concern of a lack of cash flow.

The lack and absence of steady, predictable income during retirement directly translates into poverty in old age. Retirement poverty refers to the situation where individuals lack sufficient financial resources to maintain a decent standard of living after they retire. The opposite of it is to have retirement security, but the fact is that growing older means living with less income expectations, yet savings can never be enough.

In recent times, many individuals in small businesses find themselves working well into old age, trading, hawking goods, performing manual labour, or turning to street begging. For those with health challenges, the consequences are even more dire and difficult. The informal sector contributes over 60% of Nigeria’s GDP and employs more than 80% of its workforce. Yet, the pension schemes available in the country barely cater to this segment, that is, informal micro and small businesses. The majority of workers, especially those in this informal sector, such as agriculture, petty trading, and transportation, lack social protection or a structured retirement savings plan.

Advertisement

The informal sector, which is the backbone of Nigeria’s economy, is technically and largely excluded from pension scheme coverage. For them, old age arrives with no guaranteed income, and financial security relies on extended family, faith-based charity, or sheer luck. While I agree that Nigeria’s National Pension Commission (PenCom) launched the Micro Pension Plan (MPP) in 2019 to extend coverage to informal workers, uptake remains low due to a lack of awareness, poor financial literacy, general distrust of financial institutions, and, once again, wide spread irregular cash flows.

I have realised that before now most elderly and retirees usually save up for retirement, or make property investments, especially those who are middle-income earners in Africa, but in recent time, the capacity to save for retirement is crippled by irregular or insufficient income and in particular the continued inflationary pressure. At the heart of retirement poverty is a fundamental issue: cash flow and savings. Daily earners and small business owners in Nigeria often face volatile cash inflows, which make consistent savings difficult, if not impossible. Inflation, currently hovering in double digits in Nigeria, erodes whatever little savings many manage to accumulate. For most people, survival takes precedence over long-term planning.

Retirees who worked in the informal sector largely depend on adult children or extended family networks for support. However, the erosion of traditional family structures, rural-urban migration, and economic hardships among younger generations have weakened this safety net. Considering the cost of living, rent, and transportation in a place like Lagos, Nigeria, there is no way a retiree can live comfortably without external support in the form of a constant cash flow. When food prices, fuel costs, and rent increase unpredictably, any available cash is quickly consumed by urgent needs.

Advertisement

The problem of retirement poverty in Nigeria and indeed Africa is fundamentally a cash flow problem at the individual, institutional, and national levels. Moreover, cash flow problems are not confined to individuals. Governments across the continent are grappling with delayed salary payments, arrears, and underfunded pension systems. In South Africa, although the elderly grant system provides a little relief, it is facing increasing pressure as the number of beneficiaries rises.

In Africa’s most populous country, citizens ‘ daily survival takes precedence over long-term financial planning or retirement. Workers, especially those in informal sectors like retail, farming, trading, transport, and artisanry, earn irregular income, often paid in daily cash, with no access to structured savings or pension schemes. You will agree with me that when income is uncertain and living expenses are rising, saving for retirement becomes a luxury that only a few can afford. More so, chronic cash flow challenges have turned retirement into a period of anxiety for millions.

Yet this trend is growing without any succour in sight. Without urgent intervention, the golden years risk becoming a generation’s greatest fear. Retirement security in Nigeria is not just about pension policies. When cash does not flow reliably into the hands of citizens, it cannot flow out to support them in old age. When individuals do not have consistent income, they cannot make consistent contributions. And when contributions are irregular, future retirement income becomes uncertain or non-existent.

Therefore, addressing retirement poverty and improving retirement security in Nigeria or Africa requires direct intervention in a meaningful way, such as by expanding pension schemes and financial access for informal workers, and providing social interventions.

Advertisement

More so, it is important to strengthen the awareness of pension schemes and their benefits, improve financial literacy at every level—individual, employer, and government, in particular on cash flow. Because the truth is simple: without cash flow, there is no retirement security. Only prolonged poverty will exist. Statistics and surveys have shown that poverty among older adults could worsen in a few years if the governments in Africa do not address pension coverage issues. Good luck!

How may you obtain advice or further information on the article?

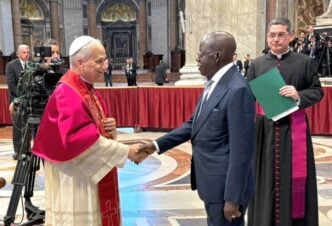

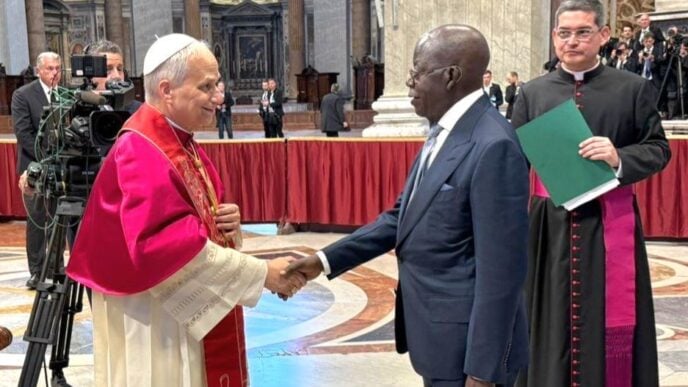

Dr. Timi Olubiyi is an entrepreneurship & business management expert with a Ph.D. in Business Administration from Babcock University, Nigeria. He can be reached on the Twitter handle @drtimiolubiyi and via email: [email protected]

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.