By Adebayo Onigbanjo

Value of Connectivity

The knowledge economy is the future of the world economy and the internet is its backbone, yet currently, only about 1 out of every 3 people can go online. Internet.org along with several organizations are focused on getting the remaining two thirds of the world to benefit from the same opportunities the connected parts of the world get today.

Internet connectivity today has already changed many aspects of the lives of individuals in developed countries ranging from new modes of communication, socialization, business models, industries and lifestyle. Today many governments already recognize the role internet access has on their economies and how it enables both economic and social development, leading to several governments developing National Broadband Plans.

Nigeria, like most developing countries today still has a low broadband penetration with the NCC executive chairman Prof. Umar Danbatta indicating it is only at 14% with optimizing to reach 30% at 2018. The Internet offers unprecedented opportunities for economic growth in developing countries. By providing access to information, connecting people to businesses everywhere, and opening up new markets, the internet can transform the very nature of an economy and support economic development.

Enabling Connectivity

Advertisement

To extend internet access in developing regions to levels seen in urban areas or developed market and to unlock the economic and social benefits, action is required. Without intervention, increase in penetration is unlikely to reach the desired levels that brings economic and social benefits. The required actions vary and require a close understanding of market dynamics and timing. Here are four key initiatives:

1. Extending infrastructure for low cost, high speed connectivity to semi-urban and rural parts – To achieve the 30% penetration, it is essential to extended the infrastructure beyond tier cities. Accelerating government programs, promoting public-private collaboration, and a supportive telecom policy could potentially improve the pace of the roll-out.

2. Enable large scale digital literacy to promote user engagement – Lack of education using the internet and lack of local language support on devices, applications and services are also holding back the penetration.

Advertisement

3. Internet based application – For the penetration to grow, there is a need for applications that go beyond the basic social media channels to the ones that address real-world challenges citizens in rural areas desire.

4. Create a favorable environment for internet businesses to both start and scale up – This includes simplifying the requirements businesses need to operate.

The NCC Price Floor

As stated above the regulator has a role to play in enabling some of this actions to be successfully implemented and positively impact the growth in internet penetration. Following the MNOs stakeholders consultative meeting of October 19th 2016 the regulator requested a price floor for data services. As you are aware the NCC has licensed several broadband operators across the country with the expectation that creating more regional licenses will enable a growth of deployment in the regions, however this has not been as successful as expected.

Advertisement

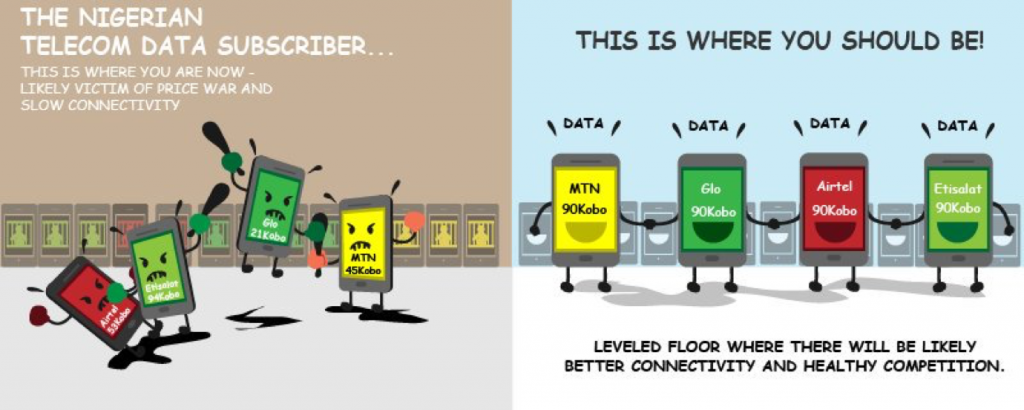

The price floor initiative was to help make the pricing competitive for the smaller and regional players so they can economically deploy networks with the knowledge that they have a price floor they can base their pricing on. The current format means that stronger operators will continue to offer a lower price and only focus in the urban cities and not encourage the rollout in the rural areas.

The price floor in 2014 was N3.11k/MB but was removed in 2015. The price floor that was supposed to flag off on December 1, 2016 was N0.90k/MB.

In taking that decision, the smaller operators were exempted from the new price regime, by their small market share. The decision on the price floor was taken to protect the consumers who are at the receiving end and save the smaller operators from predatory services that are likely to suffocate them and push them into extinction.

The price floor is not an increase in price but a regulatory safeguard put in place by the telecommunications regulator to check anti-competitive practices by dominant operators.

Advertisement

This statement clarifies the insinuation in some quarters that the regulator has fixed prices for data services. This is not true because the NCC does not fix prices but provides regulatory guidelines to protect the consumers, deepen investments and safeguard the industry from imminent collapse.

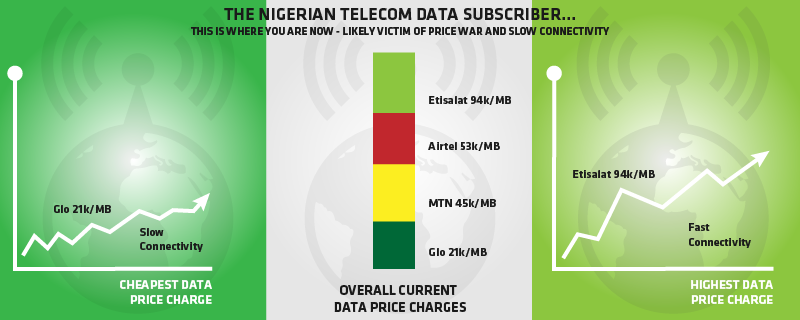

Before the new suspended price floor of N0.90k/MB, the industry average for dominant operators including MTN Nigeria Communications Limited, EMTS Limited (Etisalat) and Airtel Nigeria Limited was N0.53k/MB.

Advertisement

Etisalat offered (N0.94k/MB), Airtel (N0.52k/MB), MTN (N0.45k/MB) and Globacom (N0.21k/MB).

The smaller operators/ new entrants charge the following: Smile Communications – N0.84k/MB, Spectranet – N0.58k/MB and NATCOMS (NTEL) – N0.72k/MB.

Advertisement

While on the surface, this would be considered as a price raise for consumers, it is important to understand that this are short term approaches which will enable investors to comfortably roll-out in rural areas which in the long term will increase the broadband capacity and reduce the data tariffs.

Onigbajo is a telecom export based in Chicago, US.

Advertisement