The Development Bank of Nigeria (DBN) says it has lent at least N70 billion to over 50,000 micro, small and medium scale enterprises (MSMEs) since its establishment.

Shehu Yahaya, chairman of DBN board of directors, disclosed this while speaking at the maiden edition of the bank’s lecture series held in Abuja on Monday.

He said the bank was established to play a critical role in “promoting growth, jobs, and help address the challenges of poverty” in the country.

“For the DBN, it is early days yet. But we can say that in the first one and a half years of commencement of operation, the bank has lent more than 70 billion naira and impacted on more than 50,000 MSMEs,” Yahaya said.

Advertisement

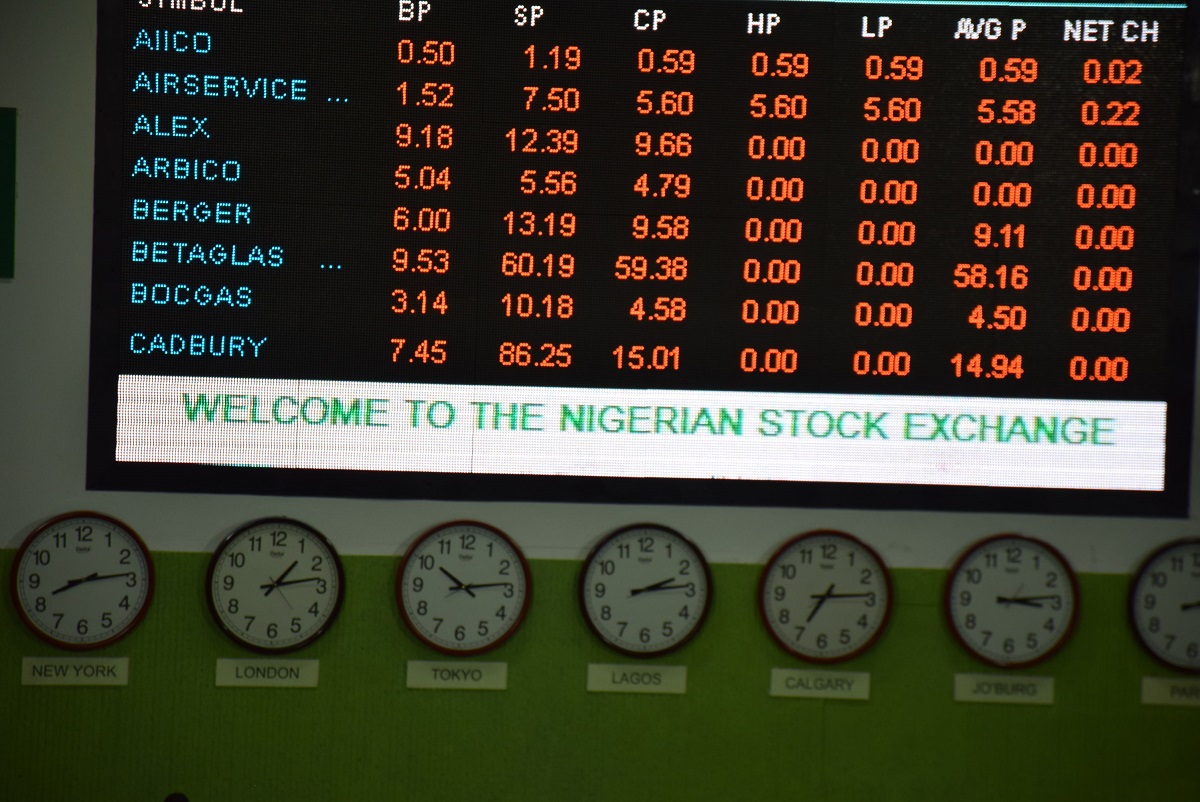

Tony Okpanachi, DBN managing director, identified access to finance as one of major concerns for the 41.5 million MSMEs which he said exists in Nigeria.

According to him, “MSMEs are the largest employers in many low-income countries including Nigeria, yet their viability and growth is restricted by lack of access to long-term debt capital.”

Okpanachi said the bank’s mandate is to alleviate financing constraints faced by the MSMEs in Nigeria “through the provision of financing and partial credit guarantees to eligible financial intermediaries on a market conforming and fully financially sustainable basis.

Advertisement

“MSMEs is the backbone for inclusive economic growth. In advanced economies, small businesses have been seen to be the driving force in achieving growth in all sectors of the economy they operate,” he added.

“Discussion from today’s lecture would help to upscale the capacity of private-finance initiates to lend to MSMEs and improve their capacity across all sectors of the economy to access and use finance efficiently.

“DBN is positioned to play a focal and catalytic role in providing funding and risk-sharing guarantees.”

Donald Kaberuka, former president of the African Development Bank and guest speaker at the lecture, described MSMEs as “the drivers of inclusive growth everywhere.”

Advertisement

“In many ways Nigeria is showing a lot of dynamism in this area; from agribusiness, retail and consumer, hospitality, entertainment, small startups in the digital space,” he said.

“I have no doubt that the DBN is off to that trajectory and will be a key factor in unlocking the potential of this great country.”