BY AMINA ADO

Nigerians want to be rich and occasionally, as a nation, we behave as if we are. How rich a country and her citizens are, can be measured by Gross Domestic Product (GDP) and GDP per capita. By these measures, Nigerians are, unfortunately, not rich, despite our collective desire to be so.

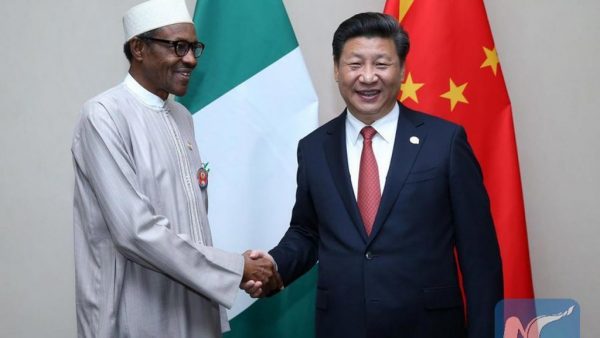

Gross Domestic Product (GDP) is a measure of the value of goods and services produced in a country in a given year. GDP can be calculated either as a value of output or equivalently as total income (salaries, profits, interests and rents) earned in a country in a year. GDP per capita, on the other hand, measures income per person and is calculated by dividing the GDP of a country by its population. According to the World Bank, Nigeria had a GDP per capita of $2230 in 2019 and was ranked 139th, just ahead of Ghana at 140th, out of 189 countries. To put it in context, China was ranked 68th with $10,262 and the United States 8th with $65,281.

So how can Nigeria become rich like China or even the United States? It is by growing the economy and one of the most important drivers of economic growth is private and public investment. Public investment involves investment in roads, railway, ports, power (infrastructure) and institutions, while private investment involves investment in manufacturing, services and so on.

Advertisement

According to the World Bank, Nigeria’s GDP per capita in 1980 was $874, while that of China was $309. Therefore, in 1980, the typical Nigerian was more than two times richer than the typical Chinese. Forty years later, the typical Chinese is more than four times richer than the typical Nigerian. So, why this significant divergence in economic fortunes within only forty years and by a country with the largest population on earth?

The 1980s was the decade when China began its phenomenal economic growth and transformation that lifted hundreds of millions of its citizens out of abject poverty. China’s growth was fuelled by an increase in investments in both manufacturing capacity and infrastructure. According to the World Bank, China’s investment to GDP ratio averaged 39.2% from 1980 to 2018, significantly higher than the world average, which was 24.9% during the period. Today, China is such an economic powerhouse that the United States and Western Europe are scared of its transformation and ascendancy.

In Nigeria, on the other hand, investments, both public and private have declined in the last decade relative to the 2000s. Between 2000 and 2010, investment was an average of 25.8% of GDP but was a paltry average of 16% between 2011 and 2018 (China: 44.7%). At a time when Nigeria’s population is still growing, the country is investing even less. With this level of investment, it should come at no surprise that economic growth in the last few years has slowed considerably compared to the 2000s. And without economic growth, there can be no reduction in poverty and all the ills it portends.

Advertisement

It is also no secret that Federal Government revenue has declined considerably in the last five years on account of low oil price. This year will be especially challenging due to the coronavirus pandemic. So, for Nigeria to get out of this perpetually low investment cycle, it has to find an alternative source of investment, perhaps through attracting foreign direct investment, or through increasing taxes or borrowing or a combination of the three. According to economic theory, increasing rates of taxation leads to a reduction in return to private investment, which negatively impacts growth. Which is obviously not what Nigeria needs at present. However, borrowing domestically, if excessive, could crowd out private investors and will also raise interest rates. This leaves us with the option of foreign loans or foreign direct investment (FDI). We have faltered in our ability to attract FDI in the last decade. So that leaves us with borrowing and this is where the loans from China come in.

Following the considerable negative comments about Chinese loans both in the local and international press, the Debt Management Office (DMO) released the details of outstanding loans Nigeria has with China Exim Bank. According to the DMO, as at end of March 2020, Nigeria has eleven active loan agreements with China Exim Bank but has only drawn down on eight, with outstanding of $3.12 billion as at end of March 2020. This is only 11.3% of Nigeria’s total external debt of $27.67 billion as at end of March 2020. Furthermore, the loans are at 2.5% interest payable over 20 years, with 7 years moratorium. Frankly, outside of World Bank and IMF loans, the terms from China Exim are as good as it gets.

Let’s examine the eight loans that we have drawn on. They are Lagos to Ibadan railway ($1.27 billion); Zungeru Hydro ($984 million); Abuja to Kaduna rail ($500 million); Abuja light rail ($500 million); Four Airport Terminals ($500 million); Abuja Keffi Makurdi road ($461 million); National Public Security ($400 million); and ICT backbone ($100 million). Very few people can doubt the usefulness of the first six projects to Nigerians. The last two (security infrastructure and ICT) are the ones that should elicit further scrutiny to determine whether these loans actually served Nigeria’s needs and were a priority.

Another fact some Nigerians are missing is the very low-interest rate of China Exim loans compared to commercial loans from the international capital market. For example, the current yield on Nigeria’s 2038 Eurobond is 8.5%. So, if Nigeria wants to issue a twenty-year Eurobond today, it will likely have to pay around 8.5% in annual interest. Assuming Nigeria borrows $1 billion for twenty years at 8.5%, with a bullet payment at the end of year 20, it will pay total interest of $1.7 billion. However, if the loan is from China for the same twenty-year tenure, Nigeria will pay interest of 2.5%, for a total of $397 million. That is a huge saving of $1.303 billion compared to a loan from the international capital market. Given these two options, Nigeria should have no difficulty choosing the Chinese option.

Advertisement

Another option is borrowing from the World Bank. But the World Bank, for reasons only known to it, provides little funding for infrastructure projects such as railway, roads and ports. Most of the loans Nigeria secured from the World Bank in the last decade are on human capital (nutrition and education), governance and safety nets. As at end of March 2020, Nigeria has $10.1 billion outstanding loans from the World Bank, which is 36.5% of total external loans, more than three times our exposure to China.

Nigerians should, on the other hand, be concerned about foreign loans from the international capital market. Presently, Nigeria has $11.17 billion outstanding in commercial loans from the international capital market, which is 40.4% of Nigeria’s total outstanding external loans, more than three times our exposure to China. The most expensive is the $750 million 2049 Eurobond (30 years) at an interest rate of 9.248%, which will cost Nigeria $2.08 billion in interest. Lenders in the international capital market are happy to take the risk, in return for a high-interest rate, and so have no need to request Nigeria to waive its sovereign immunity in the event of default. Unfortunately, there is no free lunch.

Notwithstanding the clarification and publication of pertinent details by the DMO and the advantages of loans from China Exim Bank compared to others, the controversies still continue. The latest is the issue of waiver of sovereign immunity. There is no reason to panic over this clause. China is merely ensuring that it should be able to recover its money should Nigeria default. Nigeria should not be able to claim sovereign immunity in the event of default to protect its assets, except defence and diplomatic assets. Without this clause, how else will China recover its money should Nigeria default and then claim sovereign immunity after China has won an award after arbitration? By going to war? Nigeria should not be able to borrow, at a very cheap rate from another sovereign, and then hide behind sovereign immunity in the event of default. China is right to insist on such a clause and if Nigeria one day finds itself fortunate to be lending to other countries, it should insist on such a clause.

If there is one thing most Nigerians agree on, it is that insufficient infrastructure in Nigeria is a major cost driver for businesses and also negatively impacts the quality of life of Nigerians. Whether it is noise and pollution from generators or traffic jams in Lagos or congestion at the ports, the problems can be linked to inadequate investment in key public infrastructure. These problems cannot be solved through annual budgetary allocations due to the enormous investment required and the current fiscal difficulties of all tiers of government. Loans from China to invest in key, priority and strategic public projects such as railway, power and ports could be just the catalyst Nigeria needs to address its chronic infrastructure deficit and return the economy to an annual real GDP growth rate of 5% or more. This is the minimum growth that is needed to keep per capita income rising and lift millions of Nigerians out of abject poverty.

Advertisement

The current negative press about Chinese loans is a distraction from our real problem of chronic underinvestment in infrastructure. Importantly, without investment, there will be no economic growth and without economic growth, Nigeria and Nigerians will continue to be poor. The choice is ours.

Ado is the founder of Sana’a da Ilmi Foundation, a non-profit dedicated to improving education.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.