As the coronavirus outbreak creates shockwaves across the globe, central banks and governments are enforcing emergency measures to defend their respective economies.

It was only last week that the Central Bank of Nigeria (CBN) technically devalued the naira at the investors and exporters (I&E) windows of the nation’s foreign exchange markets.

While this move may attract foreign exchange investors due to the convergence of the multiple exchange rates, it may end up stoking inflationary pressures and complicating the implementation of the 2020 budget which predicted N305 per dollar.

The CBN also announced a reduction of interest rates in all its intervention facilities from nine per cent to 5% per annum for one year while pledging to inject over N1 trillion across critical sectors of the economy.

Advertisement

With the CBN going all in out in shielding the Nigerian economy from the coronavirus outbreak, speculation is rising over the bank cutting benchmark interest rates from 13.5% in March.

Risk appetite returns as Fed goes limitless…but for how long?

As monetary policy bazookas prove ineffective against the coronavirus-induced market chaos, central banks are taking unprecedented steps in defending their respective economies against the pandemic.

Advertisement

Over the last 24 hours, the federal reserve dropped an atomic monetary bomb by announcing an open-ended unlimited quantitative easing program in an effort to promote stability across financial markets.

Although the initial reaction was somewhat mixed with shares on Wall Street closing in the red overnight, investors seem to be taking heart from the Fed’s limitless pledge, as Asian stocks roar back to life this morning and US futures jump.

However, this positive market mood is unlikely to last given how the Senate once again failed to move ahead with a $2 trillion US coronavirus stimulus package at the start of the week.

If the global economy is a tin bucket filled with water, the coronavirus outbreak has drilled multiple holes into it and monetary policy bazookas are unable to stop the water from leaking away. While fiscal policies could plug some of the holes, the solution may have to be a new bucket which in this instance is a cure to the coronavirus.

Advertisement

More pound pain as UK enters lockdown?

Sterling could be set for more weakness after Boris Johnson, the prime minister, ordered a three-week lockdown to reduce the spread of the coronavirus.

With “non-essential” shops and services being ordered to shut as part of the strict new measures, consumption could be hit, stimulating fears over the United Kingdom entering a recession.

The latest flash manufacturing and services PMI data for March will be released later this morning. The pound may end up offering a muted response to the data as investors focus on the three-week national lockdown and what it means for the economy.

Advertisement

Focusing on the technical outlook, a picture is worth a thousand words and this remains true for GBPUSD which is trading at levels not seen since 1985.

Consolidation at the lows points to further downside with the first key level of interest at 1.1400. A breakdown below this level could open the flood gates towards 1.1300 and lower.

Advertisement

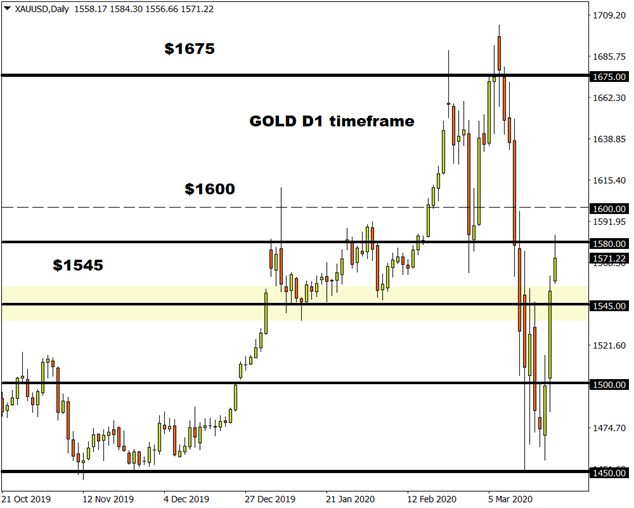

Commodity spotlight – Gold

Advertisement

Everyone has wanted a shiny piece of gold over the last 24 hours after the Fed took unprecedented measures to defend the US economy from the coronavirus outbreak.

The precious metal has appreciated over 2.7% since the start of the week and has the potential to extend gains on dollar weakness.

Advertisement

A sense of unease over the coronavirus developments and fears around a global recession should support the appetite for gold moving forward. Looking at the technical picture, the precious metal has extended gains this morning with prices trading around $1575 as of writing.

An intraday breakout above $1580 could swing open the doors towards $1600.