The World Bank says revenue remitted by the Nigerian National Petroleum Company (NNPC) Limited dropped by N500 billion in 2024 despite a surge in gross revenues collected by Nigeria’s main revenue agencies in the year.

In the latest World Bank Nigeria Development Update (NDU), published on May 12, the Bretton Woods organisation said NNPC’s remittance to the federation account dropped from N1.1 trillion in 2023 to N600 billion in 2024.

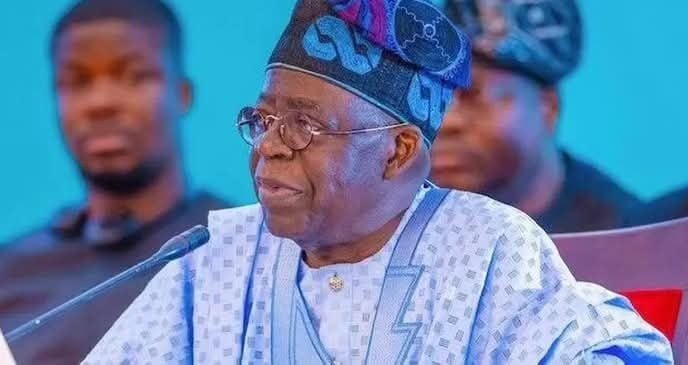

On May 29, President Bola Tinubu said the petrol subsidy regime was over.

Three months later, TheCable reported that Tinubu was considering a “temporary subsidy” on petrol as crude oil prices and foreign exchange (FX) rates soared.

Although the federal government had consistently denied the return of petrol subsidy, the NNPC, on August 19, 2024, said the federal government owes it N7.8 trillion for under-recovery.

According to the World Bank, NNPC’s remittance performance in 2024 was due to “implicit petrol subsidy,” which was in place till September 2024.

Advertisement

“Gross revenues collected by Nigeria’s main revenue agencies surged in 2024, despite minimal remittances from NNPCL,” the lender said.

“FAAC data show that gross revenues collected by the main revenue agencies (FIRS, NCS, NNPCL and NUPRC) rose significantly from N16.5 trillion (7 percent of GDP) in 2023 to N29.5 trillion (10.6 percent of GDP) in 2024.”

World Bank said the largest revenue increases came from foreign exchange-denominated sources that benefited from the removal of the FX subsidy, “including oil revenues (royalties, taxes, signature bonuses), customs revenues, and the foreign trade-related component of value-added tax”.

Advertisement

“However, NNPCL was the only laggard, remitting just N0.6 trillion to FAAC in 2024, down from N1.1 trillion in 2023, largely due to the implicit PMS subsidy, which remained in place until the end of September 2024,” the lender said.

“Although the subsidy was fully removed October 1, 2024, NNPCL did not start transferring the resulting revenue gains to the Federation until January 2025. From that point, it began remitting 50 percent, with the other half being used to settle past arrears.

“As of February 2025, NNPCL’s claimed arrears stood at N7.8 trillion, while the Federation’s claims totalled N6.1 trillion, resulting in net arrears to NNPCL of approximately N1.7 trillion, down from N3.4 trillion in September 2024, before the subsidy removal.”

‘FISCAL OUTLOOK REMAINS OPTIMISTIC’

Advertisement

Despite NNPC’s decline in remittances, the World Bank said Nigeria’s fiscal outlook remains cautiously optimistic but hinges on the necessary consolidation of recent advances.

“First, it is essential to ensure that the full revenue gains from the removal of the PMS subsidy—estimated at about 2.6 percent of GDP in 2024—are transferred to the Federation,” the bank said.

“Despite the subsidy being fully removed in October 2024, NNPCL started transferring the revenue gains to the Federation only in January 2025. Since then, it has been remitting only 50 percent of these gains, using the rest to offset past arrears.

“Resolving any remaining net arrears and channeling the full benefits of subsidy reform to the Federation is critical for sound fiscal management.”

Advertisement

‘ENSURE REVENUE GAINS FROM PETROL SUBSIDY REMOVAL’

The Bretton Woods organisation urged the federal government to ensure revenue gains from the removal of the petrol subsidy flow to the federation.

Advertisement

World Bank also asked the federal government to publish reconciled monthly fiscal reports and quarterly budget implementation reports on time.

“Publish raw FAAC data and documents from all agencies,” the bank said.

Advertisement

“Improve transparency in accounting for oil revenues by conducting a fo- rensic audit of NNPCL, and adopting standardized reporting to FAAC.”

The Bretton Woods institution also encouraged the federal government to “clear the backlog of audited financial statements for 2021-2023”.

Advertisement