Over 10 million online traders are active today. These individuals interact with different markets and instruments every day, including CFDs. And some are making a killing. You should consider joining the bandwagon and try your luck as well.

Of course, while CFD trading could be truly beneficial, you should do everything in your power to learn all the intricacies involved. So, what are CFDs, and how do you trade them? Continue reading for more answers to equip yourself with the needed information in trading CFD.

· Definition of CFDs

CFD is short for contract for difference. CFDs are derivative products that allow traders to speculate on future market prices. In other words, as a CFD trader, your primary responsibility is predicting the future market movements of specific underlying assets. The best thing about trading CFDs is that you don’t need to own or physically deliver the assets involved. You just make your speculations and earn revenue if things go your way.

· Underlying Assets

CFD trading covers various underlying assets, including commodities, stocks, market indices, bonds, foreign exchange, and shares. The most popular instruments in CFDs are stocks. Most traders prefer stocks from recognized companies because they are associated with high liquidity and significant price volatility. Additionally, most traders are familiar with how stocks work and have easy access to indispensable elements like their earnings reports.

But that doesn’t mean you should limit yourself exclusively to speculating stock prices. Before choosing an asset, first gauge factors like market liquidity and volatility. Additionally, if your portfolio has other assets, check how they might be affected by any new ones you invest in. As a CFD trader, you should also consider investing in more than one asset since that is the best way to spread risk and minimize losses.

· Leverage

Did you know you can trade CFDs without dishing out enough cash to cover your position’s total value? But to enjoy that, you must use leverage and pay a margin. The primary advantage of using leverage is that it allows you to increase your market exposure with a significantly smaller deposit.

And by doing so, you magnify your earning potential. You must also note that leveraging risks also increases your chances of incurring significant losses. So, before using leverage, weigh the pros and cons.

If you ever decide to use leverage, choose the right ratio. The exact number will depend on various factors, including the underlying asset’s behaviour, your risk-reward profile, and the size of your trading account.

Final Thoughts

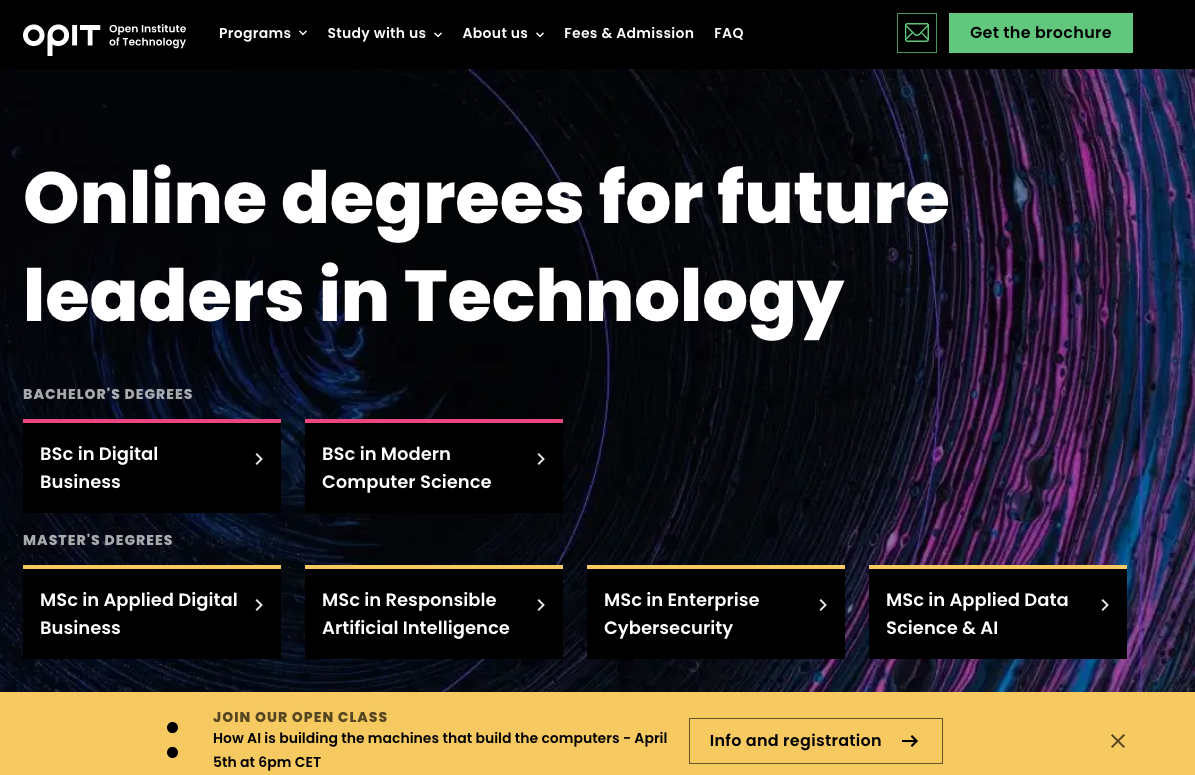

Your journey to becoming a successful CFD trader should begin with understanding the basics of CFD trading. This article has helped you to that end. But this is just the beginning. You should familiarize yourself with many other aspects, like how financial markets work and the fundamentals of technical analysis. Increase your knowledge today by enrolling in an online course.

And once you start trading, prioritize risk management. CFD trading exposes you to financial losses, just like many other risky activities out there. So be cautious, manage your funds wisely, and only risk what you can afford to lose.

Add a comment