I did not major anything in Economics or Taxation in my post-secondary education. But my elementary knowledge of taxation as an instrument of fiscal control, and public financing, makes me understand that tax is not what government uses as a one-size-fits-all solution to every problem encountered in governance. But for this administration of President Bola Tinubu, it is. Meanwhile, there are a plethora of problems in the management of a country’s economy. The Tinubu administration, therefore, sees imposition of taxes on the people as a macroeconomic “ohun gbogbo ni’se” — a broad spectrum medicine.

I quite appreciate Asiwaju’s much-touted brilliance, as rendered by the authors of his political resume, regarding how he rose to prominence with his exploit while he was in the employ of “Mobil Nigeria” as an accountant. His wizardry in financial reengineering was a major talking, even up to when he was the governor of Lagos State. But one thing stands out in his track record, since he migrated from the private to the public sector, starting with his being the Governor of Lagos State. It seems, the only instrument the man, Tinubu, has to administer is, taxing the people to the last Kobo of their earnings. This is just like the proverbial artisan whose only instrument is a hammer, and as a result, sees every problem as a nail.

Since Tinubu assumed office as the president, and Commander-in-Chief of the Armed Forces of the Federal Republic of Nigeria, his fiscal policies have been focused mainly on how to milk the already pauperised masses of this country, to maintain the privileges enjoyed by the political elite (office holders), and their economic counterparts. This has been, either by removing one subsidy, or he would be introducing a new tax handle that would punch, at least, a hole, in people’s pockets. This is all in a bid for the government to have more money to “run the government”.

Asiwaju started in office, by removing subsidy on everything the Nigerian masses enjoy, but maintains all the paraphernalia of office enjoyed by both elected public, and appointed office holders. His first port of call was petrol subsidy, which has domino effects on the economy. He then followed it up with that of electricity — something which existence Nigerians are barely aware of, or enjoy, due to the erratic nature of power supply by the various Electricity Distribution Companies (DISCOs) in the different jurisdictions in the country. That culture of poor service delivery is irrigated by a weak regulatory framework, and the inefficiency of the relevant agencies. They, therefore, mess up the “Service-Level Agreement” (SLA), at the expense of their customers, and get away with it.

ADVERTISEMENT

Advertisement

This (the removal of subsidy) is in addition to “floating the Naira”- the country’s currency, against the major currencies of the world; the US Dollar, the British Pound, and the Euro. This very policy is responsible for the abrasive erosion of the purchasing power of fixed income (salary) earners like civil servants in the country. It is as result of the fact that the economy is almost, completely “dollarised”. Remember, the “Balance of Payment,” and “Balance of Trade,” are always in the deficit. It is like a football player who joins the English Premier League, without the necessary foot gears like a pair of boots, shin guards, and other protective gears.

Having exhausted the items on which subsidies could be removed, except the non-economic item of pilgrimage to Mecca, and Jerusalem, by Muslims and Christians, respectively, he is now focused on taking more from the poor masses by way of additional taxes.

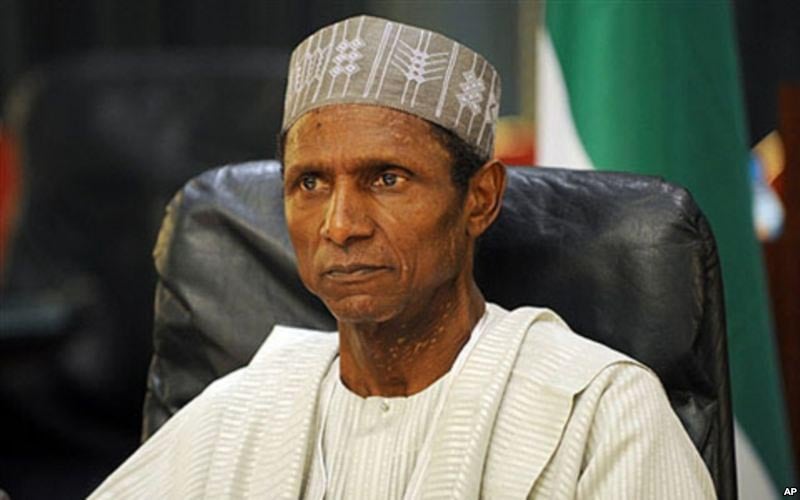

It would be recalled that, the president promised during his campaign for the last (2023) presidential election that, if elected as the president, he would “continue where Muhammadu Buhari, his predecessor stopped.” But many of us Nigerians did not know in which aspect, and never bothered to ask him then. While Buhari was in office, whenever his administration needed money, and he was told, “there was no money,” all he usually did was to send a request for parliamentary approval to obtain a loan, to the National Assembly. This habit earned his economic philosophy the sobriquet — “Kao Kudi” economic philosophy. He could even borrow in anticipation of approval. Some reports alleged that he simply ordered the central bank to print more notes to finance whatever it was that he wanted to execute. I, therefore, thought it was in those aspects Tinubu would continue his promised preservation of, and consolidation on, Buhari’s legacies in the area of political economy.

Advertisement

The President’s swashbuckling approach to the implementation of those IMF-inspired economic policies (their efficacy or otherwise not withstanding), is akin to a surgeon performing surgery on a patient (Nigerians) without anaesthesia. Meanwhile, he’s gotten away with murder on several occasions, without the masses as much as raising a whimper on most of those pain-inflicting policies he’s so far implemented.

By this time last year, a litre of petrol was below ₦200, as opposed to about ₦1000 Nigerians now pay for it. That is, if they’re lucky, that the product is available. Then, diesel was about ₦700 a litre, but today we are celebrating its fall to ₦1,400 per litre, from about ₦1,600. I don’t need to bore you with its ripple effects on costs of transportation, and those of goods and services. For instance, a 50-Kg bag of rice was between ₦28,000 and ₦33,000 before he was sworn in on May 29 last year (2023), as opposed to the current price that ranges between ₦84,000 and ₦97,000. During the period under review, a pack of paracetamol rose from ₦300 then, to ₦1,250 now. The list goes on and on.

Coming to taxes, in addition to the quasi-official executive extortionism by men in uniform in major ports of entry, and across the highways in the country, Nigerians have had to contend with having the banks pilfering their deposits by way of dubious charges that are too numerous to count. If you transfer funds to your loved ones, as a financial bailout, or buy anything and want to make electronic transfer to settle the bill, the charges are two-way traffic. The transferor gets charged ₦52 or ₦26 Naira depending on the amount sent, and the transferee, upon getting the fund would also be charged ₦50 stamp duty (this was started by the Buhari administration). Then VAT on money transferred/received will follow. Customers get charged for what they call “ATM card” maintenance. It doesn’t matter whether you applied for, got or used it. I still pay for it in one of my bank accounts, even though, I have neither applied for, nor used the card since 2020. These do not include ₦4 being charged per SMS notification. These charges’ notifications that could have been sent together in one SMS, would be sent differently, so that the number of ₦4 for SMS per transaction would be more than necessary, and return from them maximised. Remember, they subscribe to bulk SMS from telecoms service providers, which gives them a heavily discounted cost price. If you subscribe for as many as 10 to 20 million bulk SMS, you get it for as low as 45 Kobo in unit price. Imagine the profit margin, selling at ₦4, what you bought for less than 50 Kobo! You can imagine the number of transactions per minute across the land, and do the math.

Hello fellow Nigerians. Does the above explain why Nigerian banks are declaring record-breaking profits quarterly, while the real sector of the economy remains on its knees? These are banks that rarely engage in financial intermediation, as required by banking ethics and conventions. They rather invest customers’ deposits in speculative ventures like cryptocurrency, stock in a sector that is as volatile as volatility itself.

Advertisement

Tax, to my little understanding of its economics, and sociology, apart from being a source of revenue for governments, is also a fiscal instrument. It is used in regulating the economy of a geopolitical entity, both at the micro, and macro level, by the government. Its deployment depends on which of the two extremes of inflation (persistent increase in prices of goods and services), and deflation (persistent decrease in the prices of goods and services), the government wants to address or reverse. In the case of inflation, depending on the cause, it would be used to counter-balance things. If it is a demand-pulled inflation for example, tax (VAT) could be introduced to discourage, or lower demands for the commodity, or reduce the rate of consumption. Personal income tax could also be increased, so as to reduce the people’s purchasing powers for them to scale down on its consumption. If it is a cost-pushed inflation, VAT, profit tax would be reduced or removed, to lower the cost of production which by implication, reduces the prices of goods and services.

In a situation of deflation, the reverse is the case. It could be removed, or temporarily suspended, to enhance the purchasing power of the people to avoid a slide into recession, and to reflate the economy. It all depends on the policy thrust of the government of the day, at any particular point. But to the “BAT man” (Bola Ahmed Tinubu), taxation answereth all questions on the country’s economy.

Contrary to his plea upon assumption of office last year that Nigerians should be allowed to breathe — “let the poor breath,” is president Tinubu wiling to let Nigerians breathe with these multiple taxations? I doubt it.

To explain the futility in the drive by the Tinubu-led federal government’s intention to tax Nigeria to prosperity, I’d like to quote a former British Prime Minister, Winston Churchill, who once said:

“We contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.” Tinubu needs to first provide an enabling environment for Nigerians to earn taxable incomes before he can tax them.

Advertisement

Now to add insult to our injury, the Central Bank of Nigeria (CBN) announced last week that, Nigerians will start paying 0.005% as cybersecurity levy, for providing security for their bank accounts online, as they engage in electronic transactions. This is in accordance with section 44(2a) of the Cybersecurity Act, 2015 – a provision of the law that has been inactive for the past 9 years. That is not the issue here. The issue here is that, the act went further to specify the type of businesses and transactions that qualify for the levy. The crux of this piece is that, this, one-tax-too-many, has triggered the rage of the majority of the banking public, both the poor and the rich. Owing to the insensitivity of the government to the plight of the masses for the past 11 months by the government and its officials in implementing any policy that would pile more misery on Nigerians.

They did not bother to read carefully, the provisions of the act. Instead of 0.005%,they said 0.5% of every transaction. But at this juncture, the rate does not matter whether it is correct or not. It is not significant, the category of transactions being targeted. The domino effects of any tax on any business would be on all of us, as the cost would be passed on to the final consumers of what service they render, or good they sell.

Advertisement

Fellow Nigerians, need I say that cybersecurity is a part of the entire gamut of what is referred to as “national security,” and should therefore not be isolated from the rest of the components, or outsourced? It should, therefore, not be made a basis for imposing an additional tax burden on Nigerians. Let’s look at this way: I took my money to the bank for safe-keeping. I needed to use a part of it, and needed to do a business transaction. Now, they’re saying, their customers are too many to be attended to, physically and that, I should, go, get a smartphone on which I would subscribe (pay) for data to enable me access my money online. Should I be the one to pay for my money that they’ve decided to move online only for their own administrative convenience, and cost reduction, without consulting me? I don’t think so. That shouldn’t be the case. The banks should be able to factor that cost into their operating expenses. Or better still, the government should take it up and integrate it into the national security framework. After all, providing security (physical, cyber, food, medical, energy among others) is the primary reason for the existence of any responsible, and responsive government anywhere in the world. After paying, profit tax, income tax, the masses should be afforded some breathing space. Government should be sensitive enough to know that, the poor masses would be the ultimate bearer on any tax, or levy imposed on any business in Nigeria, and therefore should be reconsidered or rethought before announcing it.

It is, therefore, a welcome development that the President has reportedly ordered the CBN to suspend the implementation of the obnoxious 0.005% of every electronic transaction between bank(s) customers. The suspension was further ratified at the Federal Executive Council (FEC) meeting on Tuesday (yesterday) Meanwhile, I do not even think it is enough to suspend its implementation alone. The whole law should be reviewed and the clause on the levy be expunged, altogether, or the burden be shifted to either the banks or the federal government, through the office of the National Security Adviser (NSA). The federal government cannot be outsourcing its financial responsibilities to the already over-taxed low-income earners in the country, while the 36 State Governors do whatever they like with the so-called “security votes” which management has been stripped of any modicum of transparency, and accountability.

Advertisement

Nigerians can least bear any additional tax burden to what they already have, in the face of the galloping inflation ravaging the economy currently, which sees prices of essential services and commodities quadrupled in the last one year. This has been the story of the Nigerian man since president Tinubu assumed office. Yet, the government has been carrying on, without any commensurate pay rise, for workers. BAT should please let Nigerian masses breathe. As the noose gets tightened around their necks, so does the resilience become challenged. And if the administration does not remove his knee from the masses’ necks, and seek an alternative means of generating additional revenue for the government, or look for another fiscal instrument to control the economy, I am afraid, we might just be heading in the direction where France found itself in 1789, under King Louis – XVI, or something akin to the “Jasmine Revolution” that swept through the Middle East, and North Africa in 2011, starting from Tunisia. Nigerians are neither asking for too much, nor difficult to placate. Give them an environment, conducive enough, to work and get paid decently, and you’d become their hero, and be beatified.

If the federal government cannot provide security in all facets of our national life, what then is the “raison d’etre” of the government? Is it to rake in millions of dollars in petrol money, custom duties, and royalties collection, just to maintain our over-fed rent-seeking political elite, while the masses live in squalor? Or in case where revenues from the above sources prove inadequate, are they to borrow on behalf of the rest of us to maintain and sustain their undue privileges? If answers to the above questions are not in the affirmative, but to provide security and happiness for the greater majority of the populace, then “BAT, the taxman” should let the Nigerian masses breathe. Enough is enough. He should put a halt to his fulfillment of his promise to continue where Buhari stopped. Under one year, his deadly combination of policies has done more violence to the incomes, and standards of living of Nigerians, more than the Buhari’s did in eight years. Although, some of those policies are well-intentioned, and are desirable, their manners of implementation are comparable to performing surgery on a sick person without anaesthesia. No counter policy to mitigate the effects of the ill-timed, and ill-conceived removal of petrol and electricity subsidies as well as the floating of the Naira. What do they intend to gain by floating the currency of an import-dependent economy, if not more misery through devaluation? They did what have always wanted to do, and the results are visible to the blind, and audible to the deaf. It has made life more miserable for an average Nigerian than for citizens whose countries are at war. Is the President still telling us, “Ẹ lọ fọkàn balẹ” (go and stay relaxed, in assurance that there will soon be succour)?

Advertisement

Abubakar writes from Ilorin, Kwara state. He can be reached via 08051388285 or [email protected].

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment