Just as a new government that has innumerable internal problems and challenges to deal with comes into office, JP Morgan ushers it in with a threat to exclude Nigeria’s 10-year notes from its emerging market bond index. This presents an issue that the new government needs to address right from start in shaping its policy direction. The new administration is expected to define clearly its broad policy bearing whether Nigeria should devote itself as it has all along been doing to meeting institutional rankings or be realistic enough to focus on the critical domestic imperatives facing the nation and its people.

In the past, threats from foreign institutions such as the International Monetary Fund and western creditors informed macroeconomic policy choices here that led to economic and social chaos, wasting of scarce resources and missing critical development opportunities. Nobody is yet holding the IMF responsible for the structural adjustment policies it ordered in Nigeria and other developing countries in the 1980s.

The macroeconomic policy package named structural adjustment programme neither restructured these economies nor adjusted the external dependence problem that remains the heart of the matter even today. Instead, that programme adjusted the lives of the people to face the worst living conditions ever recorded in these countries. IMF is yet to take responsibility for its economic policy failures in developing countries.

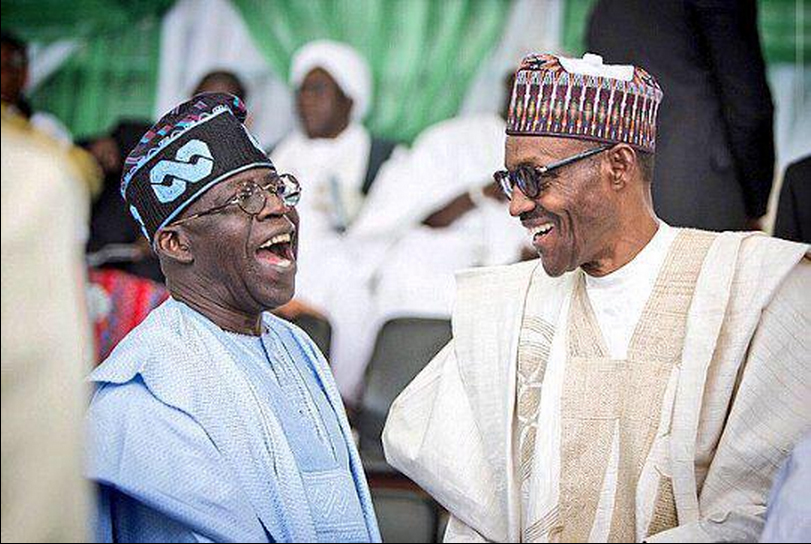

JP Morgan has come in like manner that poses for the Nigerian authorities a question whether it should focus on the circumscribing internal challenges or sacrifice these for externally instigated institutional window dressing. This is a question that President Buhari, who bears the light of Nigeria’s optimism for the future, should answer convincingly.

Advertisement

Nigeria apparently offers a far better investment climate than its institutional rankings appear to indicate. If the international image portrayed about Nigeria really matters, it is not expected that any foreign investor would ever touch it with a long stick. It appears quite sensible that the authorities can afford to forget about these rankings for now and focus on improving the living and operating conditions of people and businesses here.

There is no doubt that investors do consider institutional rankings in deciding where to invest but the fact is that serious investors have to and really do look beyond Nigeria’s institutional rankings for them to discover the great opportunities the country offers. Foreign investors had long begun to buy Nigeria’s sovereign notes before JP Morgan decided to include them in its global index. The exclusion, if it happens, isn’t going to take along with it the high return for which local and foreign investors are buying the instruments.

In the event of excluding Nigeria’s bonds from the index, a temporary selling of the instruments can be expected, which will drive down the price and increase the yield. Such a development can only be short lived because the increasing yield will at some point begin to prop up the demand once again. The initial selling pressure will expectedly register by way of foreign currency outflow and therefore mount pressure on the exchange rate of the naira but this too will be reversed or stemmed when increasing yield begins to attract a new set of investors. Overall, the level of capital outflows will be small because many foreign investors have already liquidated substantial Nigerian bond holdings.

Advertisement

A time seems to have come for Nigeria to realise that the large size of its domestic market offers it whatever it cannot get from foreign investors. Nigeria can afford to grow on the back of its large internal market and therefore needs to put in place necessary controls at this stage to reinforce this enormous internal economic potential.

Government is not expected to discount the import substitution model that has worked in cement manufacturing business and has successfully taken off in the auto industry. Controls are considered quite necessary as well in the financial markets to curb unnecessary pressure in the foreign exchange market, defend the value of the naira and stem the damaging inflationary effect of endless naira depreciation.

The revenue and cost structures of government are presently at a mismatch due to the down time of the oil market cycle and it appears quite unreasonable to expect Nigeria to pretend that all is well. The drop in the external revenue puts external reserve under a serious threat. It appears a far better option for the nation that its sovereign debt instruments are excluded from the global index than be insidiously led to run its reserve down to a vanishing point.

Nigerians are full of expectations of the new leadership and are quite impatient to see major improvements in their living conditions. The least that is expected of such a government now is to let a new phase of exchange rate depreciation devastate further the real income of consumers through the accompanying inflationary spiral.

Advertisement

The Central Bank, as an independent organ in government, is seen to have done its job professionally by taking steps to stem the demand pressure in the foreign exchange market. It is not expected that government should be stampeded from the external front to overthrow the Central Bank with a politically motivated policy decision. That, of course, will project the President that believes the naira is significantly undervalued, as playing one tune and dancing another.

It is instructive that JP Morgan did not notify Nigeria six months ahead of time before including its sovereign note in its global bond index. The six-month notice for exclusion appears to be a distraction – a spanner in the policymaking works of the new government.

The revenue constraints facing the nation at the moment have laid it bare that Nigeria cannot afford to run a completely free foreign exchange market without any official intervention. There is no such market anywhere in the world anyway. What it can offer are attractive financial markets with some of the highest rates of return in the world. The risk is commensurate with the return. Therefore high return seeking investors will be willing to take the pains to earn the high returns irrespective of where Nigeria stands on institutional rankings.

Advertisement